Chapter 6 focuses on the tools and authorities for case managers (CMs) and others to use in facilitating reconciliation and closure efforts. This chapter also discusses Foreign Military Sales (FMS) reviews, write-off authority and systemic tools

Section | Title |

|---|---|

AP7.C6.1. | |

AP7.C6.2. | |

AP7.C6.3. | |

AP7.C6.4. | |

AP7.C6.5. |

AP7.C6.1.1. There are many system tools and authorities available to aid in case reconciliation and to expedite case closure. DSCA meets periodically with the Foreign Military Sales (FMS) community to review issues and constraints encountered during case reconciliation and closure in order to establish policy to remedy situations encountered. Defense Finance and Accounting Service (DFAS) also has system tools that are available for use by the military departments to aid in lifecycle case reconciliation. Chapter 6 addresses the various system tools used to identify and track status of FMS case/lines. This section also addresses several authorities and policies in place to better assist the closure community in reconciling and closing cases. The tools and authorities addressed in Case Reconciliation and Closure Guide (RCG) Chapter 6 include write-off authority, problem disbursement resolution policy and current system tools.

The following serves as a general categorization of functions by organization:

AP7.C6.2.1. The Implementing Agency (IA) performs all case management functions prescribed in the DoD Financial Management Regulation (FMR) Volume 15 and the SAMM, optimizes the use of the tools and authorities contained herein, ensures widest possible dissemination of these tools and authorities to those involved in Foreign Military Sales (FMS) case reconciliation and closure, initiates requests for write-off approvals, effects write-off transactions in IA systems, and participates in and/or facilitates conferences addressing these issues.

AP7.C6.2.2. DSCA publishes and updates policies, approves waivers or exceptions to policies, promulgates tools and authorities to maximize reconciliation and closure performance, solicits purchaser input/feedback on ways to improve these processes, and participates in and/or facilitates conferences addressing these issues.

AP7.C6.2.3. Defense Finance and Accounting Service – Indianapolis (DFAS-IN) performs all accounting functions as prescribed in the DoD FMR Volume 15 and the SAMM, effects write-off transactions in Defense Integrated Financial System (DIFS), promulgates tools and authorities to maximize reconciliation and closure performance, and participates in conferences addressing these issues.

AP7.C6.2.4. Defense Contract Management Agency (DCMA) works directly with Defense suppliers to help ensure that DoD, Federal and allied government supplies and services are delivered on time, at projected cost and meet all performance requirements. In addition, DCMA performs contract administration, quality assurance and inspection functions for the DoD as prescribed in the Federal Acquisition Regulation (FAR) and Defense Federal Acquisition Regulation Supplement (DFARS), and performs contract closeout in accordance with the DCMA Guidebook.

AP7.C6.2.5. Defense Contract Audit Agency (DCAA) performs all contract audits for the DoD as prescribed in the FAR and DFARS including final overhead rate audits required to "final" close FMS cases. In addition DCAA provides accounting and financial advisory services regarding contracts and subcontracts to all DoD components responsible for procurement and contract administration.

AP7.C6.2.6. Office of the Under Secretary of Defense (Comptroller) (OUSD(C)) publishes, updates, and clarifies financial management policies contained in the DoD FMR Volume 15.

A wide range of tools exist to aid in the timely and accurate reconciliation and closure of Foreign Military Sales (FMS) cases. Some of these tools were discussed in earlier chapters, such as the case review and reconciliation matrix/checklist (Refer to Section AP7.C2.). In addition, the following publications serve as tools:

AP7.C6.3.1. Publications:

- This guide

- DoD Financial Management Regulation (FMR) Volume 15 and Volume 3, Chapter 11

- SAMM, particularly Chapter 16

- Defense Security Cooperation University (DSCU) Security Cooperation Billing Handbook (The Red Book)

- Security Cooperation Management (The Green Book)

- Other tools aimed at facilitating reconciliation and closures are discussed in the following sections.

AP7.C6.3.2. Case Financial Status Reports. Case financial status reports are used to provide a summary level analysis of the country's open FMS cases. Since their preparation constitutes one possible event for the annual case review requirement, their accuracy, completeness and data integrity are vital. The case manager (CM) participates in decisions and resolves FMS case action items resulting from information contained on the case financial status reports which are used at various meetings, conferences, and visits.

AP7.C6.3.3. Conferences.

AP7.C6.3.3.1. Security Cooperation Case Management and Closure Workshop. Members from DSCA, the IAs, DFAS Indianapolis and the purchasers attend the workshop held annually (usually June timeframe). Discussions concern financial policy issues (current, pending and proposed) impacting FMS case reconciliation and closure, and reconciliation issues throughout the case execution phase, SSC phase and in preparation for closure. DSCA (OBO/FPRE) chairs the workshop.

AP7.C6.3.3.2. Implementing Agency Conferences. The IA’s hold, at their discretion, conferences to address reconciliation/closure issues at a more detailed level.

AP7.C6.3.4. Write-Off Authority. (See DoD FMR Volume 15, Chapter 2, Section 0211). Refer to DoD FMR Volume 15, Chapter 3, Section 0310. A DoD Component which determines that unresolved reconciliation issues for a case exist may write-off those imbalances using the following guidelines.

AP7.C6.3.4.1. For Problem Disbursements. Problem Disbursement (PD) write-off authority exists for up to $2,500 per transaction. Refer to DoD FMR Volume 3, Chapter 11 for an elaboration of the policies and procedures relative to PDs. PDs greater than $2,500 should be brought to the attention of the DSCA Comptroller (Office of Business Operations, Comptroller Directorate (OBO/CMP)) via the Case Closure Mailbox (dsca.ncr.dbo.mbx.case-closure-requests@mail.mil) for resolution, provided those PDs have not exceeded the timelines noted in Section AP7.C2.10.

AP7.C6.3.4.2. For All Other Types of Foreign Military Sales Financial Transactions. Write-off authority exists for up to $200 per transaction (for other than SDRs) and is charged against the FMS Administrative Charge Budget, object classification 42.3, "Supply Discrepancy Reports Charged for FMS Cases" for the amount required to effect prompt reconciliation as prescribed in the DSCA annual case review requirement (See Figures AP7.C2.F5., AP7.C2.F6., and AP7.C2.F7.). For write-off adjustments performed in support of readying a case for closure, DFAS-IN provides DSCA (OBO/FPRE) with a quarterly summary of closure certificates received in which amounts have been charged in accordance with this policy. A comment shall be included in the remarks/comments section of the case closure certificate (refer to Section AP7.C4.7.) when those write-offs are utilized.

Figure AP7.C6.F1. Request for Resolution of Problem Disbursement in Excess of $2,500

AP7.C6.4.1. Refer to Section AP7.C2.10. for information on how to resolve Problem Disbursements (PDs).

The objective to improve case closure by improving case execution is accomplished by ensuring that adequate Information Technology (IT) tools exist to assist the case manager (CM) in performing "best case execution" practices. Improved case execution promotes better data integrity, increased responsiveness to the purchaser's informational needs, a more efficient use of DoD resources, and timely case closures. The following tools assist with case closure reconciliation and are applied throughout the Implementing Agencies (IAs), Defense Finance and Accounting Service - Indianapolis (DFAS-IN) and the DoD Foreign Military Sales (FMS) case management community:

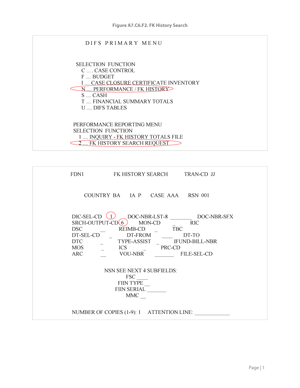

AP7.C6.5.1. Defense Integrated Financial System Foreign Military Sales Detail Delivery FK History Search. The Defense Integrated Financial System (DIFS) history search provides DIFS performance history details on delivery performance as well as progress payment performance ('NA'/'ND' transactions). It provides Reimbursement codes to determine Liquidating and Non-Liquidating detailed costs, Delivery Source Codes, Price Codes, as well as Stock Fund Add On, Contract Administration Services (CAS), Logistics Support Charge (LSC), Accessorial and Admin costs. The DIFS History Search can be used at closure reconciliation to manually compare what was recorded in DIFS vs. what was recorded in the IA system at the case, line item or detail/requisition level. The DIFS history search is available through an online request in DIFS using the selections as outlined in Figure AP7.C6.F2. The performance transaction types can be identified as listed in Table AP7.C6.T3.

Figure AP7.C6.F2. FK History Search

Table AP7.C6.T3. Defense Integrated Financial System History Search Performance Transaction Types

Click to view:

Table AP7.C6.T3. Defense Integrated Financial System History Search Performance Transaction Types

AP7.C6.5.2. Mechanization of Contract Administration Services.

AP7.C6.5.2.1. Description. Mechanization of Contract Administration Services (MOCAS) permits a greater degree of automation in procurement and contract administration. MOCAS interactively provides information on invoices processed against DoD contracts that DFAS is responsible for paying. MOCAS pays invoices for hardware supplies and services using Electronic Data Interface (EDI) for receipt and storage of commercial invoices, requests for progress payment and public cost vouchers. DFAS payment offices use MOCAS as the administration payment system.

AP7.C6.5.2.2. Utilization. MOCAS is a database system designed to provide:

AP7.C6.5.2.2.1. Defense Contract Management Agency (DCMA) with information necessary to accomplish their mission for contract administration production and quality assurance.

AP7.C6.5.2.2.2. Management, financial and inventory data to purchasers (services), buying offices, funding offices, and inventory managers.

AP7.C6.5.2.2.3. Payment to contractors or their designee.

AP7.C6.5.2.2.4. Disbursement information for Defense Finance and Accounting Service (DFAS).

AP7.C6.5.2.2.5. Reports to the military department for transmission to both internal and external stakeholders as required.

AP7.C6.5.2.2.6. Automatic closeout of contracts as prescribed by the Federal Acquisition Regulation (FAR).

AP7.C6.5.2.2.7. Maintenance of source documents for all of the above.

AP7.C6.5.2.2.8. Obligation and payment histories at the detail level, which can be manually compared to the IA system records. This is used during the case closure reconciliation to confirm the accuracy of final expenditures in the IA systems.

AP7.C6.5.2.3. Mechanization of Contract Administration Services Financial Subsystem. The financial subsystem is made up of distinct database records. These records contain all the information necessary for the research and payment of an invoice. They include contract administration information, accounting line data, Contract Line Item (CLIN) data, shipment data, invoice data, and financial history data. Table AP7.C6.T4. is a brief description of these records.

Table AP7.C6.T4. Mechanization of Contract Administration Services Financial Subsystem Data Elements

Click to view:

Table AP7.C6.T4. Mechanization of Contract Administration Services Financial Subsystem Data Elements

AP7.C6.5.3. Standard Contract Reconciliation Tool

AP7.C6.5.3.1. Purpose. Standard Contract Reconciliation Tool (SCRT) was developed as a tool for the reconciliation of MOCAS paid contracts.

AP7.C6.5.3.2. Requirements. The data records must be maintained and used to verify whether an adjustment was necessary. The Responsible Contract Reconciliation Agent (RCRA) documents the adjustment within the contract folder. Generally, those records include (but are not limited to) contract modifications, payment vouchers and printouts of any retrieval used. A user must also have access as a SCRT reconciler to be able to perform a SCRT adjustment

AP7.C6.5.3.3. Adjustment Process. If an error is identified within either the IA accounting system records or the MOCAS records and an adjustment is required, the RCRA must approve those corrections in SCRT. Once the adjustment is approved in SCRT, it is then interfaced with MOCAS where it updates MOCAS records. If properly done, the update to MOCAS creates a 1S1/1B1 record that is passed to the Accountable Station to update the accounting system. There are a few exceptions to this – most notably new records cannot be generated (a record that did not already exist) e.g., a new contract may be added to SCRT, a payment cannot be posted to a contract that never had a payment posted to it.

AP7.C6.5.4. Electronic Document Access. Electronic Data Access (EDA) uses the Internet to provide DoD on-line access to share, store and retrieve contracts and other documents electronically. EDA offers read-only access to official contracts, contract modifications, vouchers, Government Bills of Lading and accounting and finance documents. EDA provides one common file format that eliminates the need to maintain hard copy files, reducing the need to print, mail, file, and manage paper. EDA is a means to access a contract or a contract modification using the internet for viewing purposes only.

AP7.C6.5.5. Shared Data Warehouse. SShared Data Warehouse (SDW) provides a central repository of uniform data for shared access to support the DoD network. SDW is a non-Online Transaction Processing (OLTP) Oracle database updated daily with MOCAS transaction data. SDW is a query-only web site and requires a User-ID and password. A new SDW called DFAS Corporate Warehouse (DCW) is being developed for the DFAS Corporate Database (DCD). SDW receives file transfers of contract awards and modifications.

AP7.C6.5.6. Contract Reconciliation System. Contract Reconciliation System (CRS) is much the same as SCRT, with a few significant differences. Only DFAS has the ability to input into CRS. CRS can be used to directly update MOCAS and unlike SCRT, the limitation on new records does not exist. There are defined requirements for CRS adjustments.

AP7.C6.5.7. Security Cooperation Information Portal. DSCA’s Security Cooperation Information Portal (SCIP) assembles corporate information from FMS legacy systems Centralized Integrated System for International Logistics (CISIL), Security Assistance Management Information System (SAMIS), Case Management Control System (CMCS), Management Information System for International Logistics (MISIL), Defense Security Assistance Management System (DSAMS) and DIFS, and provides that consolidated information to the purchaser and DoD users in a common format. It provides a secure avenue for information exchange and data assurance.

AP7.C6.5.8. Other Internet Links.

Organization | Link |

|---|---|

USG regulations: | |

Defense Security Cooperation Agency: | |

Office of the Under Secretary of Defense (Comptroller): | |

Defense Finance and Accounting Service: |