Section | Title |

|---|---|

AP7.C1.1. | |

AP7.C1.2. | |

AP7.C1.3. | |

AP7.C1.4. | |

AP7.C1.5. |

The Case Reconciliation and Closure Guide (RCG) is authoritative for the reconciliation and closure of both Foreign Military Sales (FMS) and Building Partner Capacity (BPC) cases. This guide consolidates reconciliation and closure processes and procedures into a single document and complements reconciliation and closure policy in the DoD Financial Management Regulation (DoD FMR) DoD 7000.14-R, and the Security Assistance Management Manual (SAMM), DSCA 5105.38-M, particularly Chapter 16, Case Reconciliation and Closure. It is intended to identify the procedures and facilitate actions by providing an overview of the processes related to reconciliation and closure. The structure is outlined below, and every effort is made to ensure this document is user-friendly, comprehensive, relevant and concise. The RCG is considered a "living" document and is subject to change as policies and procedures change.

AP7.C1.2.1. The Case Reconciliation and Closure Guide (RCG) contains six chapters, including this introductory chapter, pertaining to the processes related to case reconciliation and closure. It also includes a table of contents, labeled is Chapter 0. In addition to the RCG’s authorization memo, a listing of tables, and figures, Chapter 0 contains definitions, abbreviations/acronyms and references. All chapters apply to the entire Foreign Military Sales (FMS)community. Problem resolution and process flowcharts apply to each chapter. A brief description of chapters 2-6 follows:

AP7.C1.2.1.1. Chapter 2: Execution Phase Reconciliation. Chapter 2 details reconciliation requirements during the FMS case execution phase, after implementation and before supply and services completion. In addition, this chapter discusses the critical linkages between Letter of Offer and Acceptance (LOA) development and execution. This chapter also outlines the links between the LOA and supporting funding documents (including contracts), funds realignment principles, FMS surcharges, problem disbursement resolution authority, detailed review/reconciliation requirements, system interfaces and Supply/Service Complete (SSC) criteria.

AP7.C1.2.1.2. Chapter 3: Reconciliation for Closure of Supply/Services Complete Cases. Chapter 3 focuses on reconciliation requirements once a case is SSC and guidelines for preparing a case for closure. Specifically, this chapter discusses closure types, closure inhibitors and verifications required to prepare a case for closure.

AP7.C1.2.1.3. Chapter 4: Closure. Chapter 4 outlines the closure process and includes information regarding certificate transactions and closure inhibitors once the certificate reaches Defense Finance and Accounting Service - Indianapolis (DFAS-IN). This chapter also documents the verifications required for post-closure transactions, contract closeout, the Case Closure Suspense Account (CCSA), reopening cases, zero value closures and closure of leases.

AP7.C1.2.1.4. Chapter 5: Reports. Chapter 5 provides an overview of the reporting of reconciliation and closure efforts. Reporting requirements, DSCA Case Closure Status reporting, and the CCSA Statement are discussed.

AP7.C1.2.1.5. Chapter 6: Tools and Authorities. Chapter 6 focuses on the tools and authorities for case managers (CMs) and others to use in facilitating reconciliation and closure efforts. This chapter also discusses FMS reviews, write-off authority and systemic tools.

AP7.C1.2.1.6. Table of Contents. Chapter 0 provides links to the necessary reference material utilized throughout the RCG. The Abbreviations and Acronyms Appendix provides the user with a comprehensive list of all the abbreviated naming conventions found in the RCG. Additionally, the Definitions Appendix provides the user with the description and explanations of the wording used throughout this document.

The reconciliation and closure of a Foreign Military Sales (FMS) case involves a wide range of organizations. A brief description of the roles and responsibilities of these organizations follows:

AP7.C1.3.1. Implementing Agencies (IAs) perform all case management duties prescribed in the SAMM, and serve as overall manager and facilitator for reviewing and reconciling cases. The IA also ensures data integrity on reports and information products within and between data automation tools through periodic reviews, meets with stakeholders (to include purchasers) to resolve issues, and certifies cases to Defense Finance and Accounting Services – Indianapolis (DFAS-IN) for closure.

AP7.C1.3.2. DSCA prepares Letter of Offer and Acceptance (LOA) documents, publishes, updates, and disseminates reconciliation and closure policy, chairs various FMS reconciliation and closure meetings, and serves as final arbiter for case reconciliation and closure issues raised by IAs and DFAS-IN.

AP7.C1.3.3. DFAS-IN performs all accounting functions prescribed in the DoD Financial Management Regulation DoD FMR and the SAMM ensures data integrity of the case, meet with stakeholders to resolve issues, and closes cases.

AP7.C1.3.4. The Defense Contract Management Agency (DCMA), when assigned as the Administrative Contracting Officer (ACO), performs contract administrative functions (including contract closeout) as prescribed in the Federal Acquisition Regulation (FAR) and the Defense Federal Acquisition Regulation Supplement (DFARS).

AP7.C1.3.5. The Defense Contract Audit Agency (DCAA) performs contract audit functions as prescribed in the FAR and the DFARS, including final overhead rate audits necessary to close out contracts that, in turn, lead to closure of FMS cases.

AP7.C1.3.6. Purchasers advise on which cases are desired for closure, coordinate closure decisions between: (a) Ministry of National Defense (MND or equivalent thereof) and (b) Service/program office level, ensure prompt payment for cases in a collection deficit (i.e., underpaid) position, participate in reconciliation and closure meetings (e.g., Financial Management Reviews (FMRs)), and meet with USG representatives to resolve issues.

AP7.C1.4.1. Effective reconciliation benefits both the purchaser and the USG. For the purchaser, implementing reconciliation as promptly as possible is a benefit that returns surplus funds, assists in controlling fiscal year spending, reduces administrative and overhead costs, and increases the speed in which discrepancies are found and resolved. Purchaser benefits also pertain to the USG since the purchaser can free up funds for other efforts, to include new FMS cases. In addition, reconciliation emphasizes responsible stewardship of Foreign Military Sales (FMS) cases, maintains USG credibility, promotes the use of sound financial policies, maintains FMS case schedule, and optimizes the use of resources.

AP7.C1.4.2. Reconciliation refers to the financial and logistical actions that ensure proper accounting, accuracy and thoroughness of data, currency of schedules, and timeliness and completeness of reporting. Successful reconciliation throughout the life of a case expedites case closure. Reconciliation begins when the FMS case is implemented. Per the SAMM Section C6.1., "implementation" is defined as when the purchaser accepts the Letter of Offer and Acceptance (LOA) (via signature thereon), the initial deposit is received in the purchaser's Trust Fund or other designated account, and the accepted LOA is established in FMS management systems. On an exception basis, DSCA (Office of Business Operations (OBO)) can authorize emergency implementation of an LOA in advance of initial deposit receipt. Emergency Implementation actions should be coordinated with the applicable Implementing Agency (IA). Refer to SAMM Section C6.1.2. for policy on emergency implementation.

AP7.C1.4.3. All cases must be reviewed annually, either upon the basic case implementation anniversary date, in preparation for a formal review with the purchaser, or when the case value adjusts by a ten percent or more increase or decrease. Refer to the FMS Case Review and Reconciliation Matrix and associated guidelines, and the checklist in Appendix 7, Chapter 2 and Chapter 3 for additional details on reconciliation process and procedures.

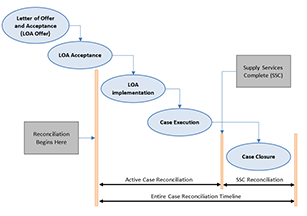

AP7.C1.4.4. There are two stages of reconciliation: Active case reconciliation, which begins at case implementation and ends at Supply/Service Complete (SSC); and SSC reconciliation, which begins at SSC and ends at "final" case closure. A general depiction of when reconciliation occurs during the life cycle of an FMS case is shown in Figure AP7.C1.F1. Figure AP7.C1.F2. illustrates the transition from active case reconciliation to SSC reconciliation and closure as well as how to determine which closure method to use in conjunction with Table AP7.C3.T1.

Figure AP7.C1.F1. Transition From Case Execution To Closure

Closure refers to a case for which all material has been delivered, services have been performed, other requirements of the Letter of Offer and Acceptance (LOA) have been satisfied, known financial transactions (including collections) have been completed, and the purchaser receives a final statement of account in the next Defense Department (DD) Form 645, "Foreign Military Sales Billing Statement". From a practical and operational standpoint, "final" case closure marks the conclusion of the life of a given case. It is DSCA policy to close a Foreign Military Sales (FMS) case as soon it is feasible to do so. Cases are not considered candidates for closure until Supply/Service Complete (SSC), meaning all logistical actions are completed and all conditions of the LOA are satisfied. An elaboration of SSC criteria is found in Appendix 7, Section C2.13. The two broad categories of closure are: Accelerated Case Closure Procedures (ACCP) and non-ACCP. ACCP is voluntary except for those countries with Foreign Military Financing (FMF)-funded cases. For cases categorized under ACCP, not all financial transactions are necessarily complete prior to closure. The non-ACCP category exists to accommodate those countries whose FMS programs are completely financed with national funds (cash) and have not elected to participate in ACCP, as well as all Building Partner Capacity (BPC) cases. Non-ACCP cases must be fully reconciled prior to closure. Non-ACCP requires that all financial transactions are complete/finalized, and cases must be fully reconciled prior to closure.

AP7.C1.5.1. Closure is important to FMS cases for many reasons. In addition to the many benefits noted in the reconciliation section, closure also minimizes the inventory of open cases that are logistically, but not financially, complete; expedites the release of excess funds; allows for resources to focus on active cases; and addresses the purchaser's concern of timely and efficient closure.

AP7.C1.5.2. Accelerated Case Closure Procedure. Cases should be certified for closure under ACCP within 24 months post-SSC, and it is preferred that they are closed as soon as possible once they are 12 months post-SSC (exceptions are addressed in Appendix 7, Chapter 3). The period of 12 months following final delivery of defense articles before a case is closed allows for final reconciliation actions and considers the purchaser’s right to submit a Supply Discrepancy Report (SDR) associated with the final delivery. The 12-month SDR period is calculated using the delivery date or passage of title for defense articles, not SSC status date. A partner’s ability to submit a SDR for is not restricted simply because a case entered SSC status. This 12-month period before case closure can be reduced, however, if the purchaser can confirm in writing (e-mail or meeting minutes are acceptable) that the submission of SDRs is not anticipated. This statement does not waive the FMS purchaser’s right to submit an SDR as indicated in the LOA Standard Terms and Conditions, Section 5.4. The underlying contracts supporting the FMS case do not need to be completed for the FMS case to interim close if there are Unliquidated Obligations (ULOs) on the contract associated with the FMS case, or to direct final close if there are no ULOs associated with the FMS case. The detailed procedures for ACCP are discussed in Appendix 7, Chapters 3 and Chapter 4.

AP7.C1.5.3. Non-Accelerated Case Closure Procedure. Cases are eligible for non-ACCP closure certification typically when they have been SSC for 12 months and financially complete. The 12 months allows for consideration of the purchaser’s right to submit an SDR associated with the final delivery. This time period can be reduced, however, if the purchaser confirms in writing (e-mail or meeting minutes are acceptable) that the submission of SDRs is not anticipated. This statement does not waive the FMS purchaser’s right to submit an SDR as indicated in the LOA Standard Terms and Conditions, Section 5.4. Financially complete refers to the fact that there are no ULOs on underlying contracts for the case and all costs are determined, final billed and collected. For major system sales in particular, this often delays closure by several years or more. Detailed procedural guidance for Non-ACCP cases is found in Appendix 7, Chapters 3 and Chapter 4.

Figure AP7.C1.F2. Transition From Case Execution To Closure