Chapter 2 details reconciliation requirements during the Foreign Military Sales (FMS) case execution phase, after implementation and before supply and services completion. In addition, this chapter discusses the critical linkages between Letter of Offer and Acceptance (LOA) development and execution. This chapter also outlines the links between the LOA and supporting funding documents (including contracts), funds realignment principles, FMS surcharges, problem disbursement resolution authority, detailed review/reconciliation requirements, system interfaces and Supply/Service Complete (SSC) criteria.

Section | Title |

|---|---|

AP7.C2.1. | |

AP7.C2.2. | |

AP7.C2.3. | |

AP7.C2.4. | |

AP7.C2.5. | |

AP7.C2.6. | |

AP7.C2.7. | |

AP7.C2.8. | |

AP7.C2.9. | |

AP7.C2.10. | |

AP7.C2.11. | |

AP7.C2.12. | |

AP7.C2.13. | |

AP7.C2.14. | |

AP7.C2.15. | |

AP7.C2.16. | |

AP7.C2.17. | Military Interdepartmental Purchase Request (MIPR, DD Form 448) |

Critical components of effective Foreign Military Sales (FMS) case management involve active case review and reconciliation, beginning from Letter of Offer and Acceptance (LOA) implementation until the case is Supply/Service Complete (SSC). It is mandatory that each case manager (CM) perform an annual case and payment schedule review and/or reconciliation on each case starting at the implementation of a case in order to ensure accurate and current case data and to facilitate successful case closure. This includes comparing data between systems, comparing LOA data to performance, comparing LOAs to underlying contracts and comparing systemic data to hardcopy or electronic supporting documentation. The benefits of reconciliation are realized by not only the purchaser (which, by itself, is important enough), but also by the USG. This chapter is dedicated to addressing any transactions that collectively represent active case reconciliation, which includes, but are not limited to relationships, case reviews and reconciliation requirements, funding documents, FMS reviews, LOA revisions and surcharges. This chapter is organized to follow the logical steps associated with the various processes that occur in active case reconciliation; however, some processes may overlap.

The following serves as a general categorization of active case reconciliation functions by organization.

AP7.C2.2.1. Implementing Agency. The Implementing Agency (IA) performs all case management functions cited in the DoD Financial Management Regulation (DoD FMR) 7000.14-R and the SAMM and reconciles cases throughout the execution phase. The IA performs annual case reviews and reconciliations in accordance with the following figures: AP7.C2.F5., AP7.C2.F6. and AP7.C2.F7. The IA also ensures timely and accurate delivery reporting, resolves Supply Discrepancy Reports (SDRs), and ensures timely notification of case logistical and financial status to purchasers by updating systems, processing Letter of Offer and Acceptance (LOA) amendments and modifications, and realigning funding. Furthermore, the IA processes/accepts all funding documents and associated documentation, adheres to audit trail requirements, and coordinates internal reconciliation actions with contracting officials, CMs, purchaser, Defense Finance and Accounting Service (DFAS), and reconciliation/closure officials. The IA consults with DFAS as appropriate to ensure integrity between logistical, financial, and official accounting records. The IA is also responsible for resolving problem disbursements in coordination with DFAS, conducting Foreign Military Sales (FMS) reviews (internal and external with customers), determining when cases/lines are Supply/Service Complete (SSC) and establishing internal reconciliation procedures and guidelines that complement those contained in this guide.

AP7.C2.2.2. Defense Security Cooperation Agency. DSCA publishes, updates, and disseminates reconciliation policies, serves as final arbiter for case reconciliation issues raised by IAs and DFAS, reviews SDRs valued over $50K for final resolution, and meets with purchasers to resolve issues.

AP7.C2.2.3. Defense Finance and Accounting Services - Indianapolis. Defense Finance and Accounting Services - Indianapolis (DFAS-IN) works with IAs on reconciling cases, provides Expenditure Authority (EA), performs all accounting functions as prescribed in the DoD FMR (Volume 15) and the SAMM, resolves problem disbursements in coordination with IAs, and accepts/rejects IA systemic transactions and provides feedback reporting to IAs and meets with customers to resolve issues.

AP7.C2.2.4. Purchasers. Purchasers assist in determining the case/line logistical status, confirm case/line is SSC, submit SDRs as appropriate, notify the USG community of desired changes in scope during execution as well as participate in meetings and FMS reviews.

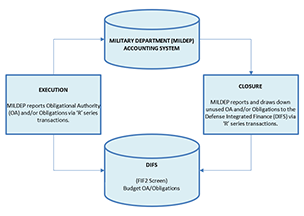

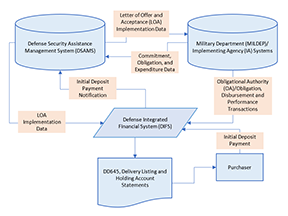

The overall financial flow for an implemented Foreign Military Sales (FMS) case occurs as follows. Subsequent to implementing the case in the Defense Security Assistance Management System (DSAMS), the case manager (CM) determines how the funds shall be distributed to the various activities responsible for providing material and/or services. The Obligational Authority (OA) is issued and recorded in DSAMS and the official Implementing Agency (IA) accounting system. Commitments and obligations are recorded in the IA accounting system then once payment has been made, expenditures are recorded in the IA accounting system and reported to DSAMS at the case summary level. The IA also reports OA and/or obligation values to the Defense Integrated Financial System (DIFS) via the 'R' series transactions. DIFS approves Expenditure Authority (EA) and interfaces with the disbursing office prior to processing payments. EA is issued by Defense Finance and Accounting Services – Indianapolis (DFAS-IN) via DIFS to certifying officers/disbursing activities authorizing the subsequent disbursement of a purchaser funds. Once the IA accounting system receives the payment transactions and records the expenditures, disbursements are forwarded via 'S' series transactions and performance via 'NA/ND' transactions from the IA accounting system to DIFS. Accurate DIFS reporting is essential in order for DFAS-IN to correctly charge the purchaser via the Defense Department (DD) Form 645, "Foreign Military Sales Billing Statement" (Refer to Figures AP7.C2.F1., Figures AP7.C2.F2. and AP7.C2.F3.).

Figure AP7.C2.F1. Obligational Authority and Obligations

Figure AP7.C2.F2. Flow of Funds

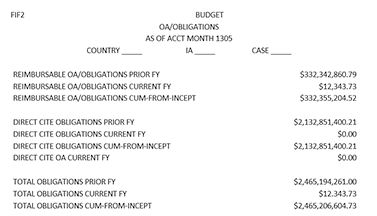

Figure AP7.C2.F3. Defense Integrated Financial System Budget Obligational Authority /Obligations Query

The relationships covered in this section will give the user an overarching understanding of how various processes, documents, and interactions associated with the management of the case directly impact timely reconciliation and closure. There are relationships between documents, such as the Letter of Offer and Acceptance (LOA) and funding documents, as well as relationships between organizations in the case closure process, such as the case manager (CM) and Defense Finance and Accounting Services (DFAS). All of these processes and documents must coalesce to ensure that a case is made ready for closure. In addition, the organizations involved must work together to ensure all necessary steps are completed prior to initiating closure.

AP7.C2.4.1. Letter of Offer and Acceptance: Contract/Funding Document. Lack of timely reconciliation of contracts and other funding documents supporting Foreign Military Sales (FMS) cases is one of the most significant obstacles precluding efficient case execution and closure. The following should be considered:

AP7.C2.4.1.1. One LOA may involve one or more contracts/funding documents.

AP7.C2.4.1.2. One contract can support one or multiple LOAs. When there is a common item or service being procured, it is routine that both domestic and foreign requirements will be implemented on the same contract. This is done for numerous reasons including ensured interoperability and cost savings by purchasing in larger quantities (Refer to Figure AP7.C2.F4).

Figure AP7.C2.F4. Foreign Military Sales Case: Contracting Relationships

AP7.C2.4.1.3. For contracts, the Source of Supply (SOS) code for the associated LOA lines must be 'P' (from new procurement) or 'X' (mixed source, such as stock and procurement, or undetermined). For other funding documents, the SOS code may be 'P', 'X' or 'S' (shipment from DoD stock, or performed by DoD personnel). Table AP7.C2.T1. provides an inventory of the various documents that impact funding for FMS cases. In addition to several internal IA documents, a specific common document is the Military Interdepartmental Purchase Request (MIPR) (DD Form 448). AP7.C2.17. at the end of this chapter provides detailed information on the MIPR process; it is provided to promote understanding of an oftentimes unclear process.

Table AP7.C2.T1. Documents Impacting Funding

Click to view:

AP7.C2.4.1.4. The contract type may influence the complexity and timeline associated with completing financial transactions related to that contract. For example, Federal Acquisition Regulation (FAR) section 4.804-1(a), provides the time standards for contract closeout. Firm fixed price contracts, other than those using Simplified Acquisition Procedures (SAP), should be closed within six months after the contracting officer receives evidence of physical completion. For cost-type contracts, the time standard is 36 months. When applicable, quick closeout procedures contained in FAR section 42.708, may be used. The quick closeout procedures do not apply in all circumstances.

AP7.C2.4.1.5. Incentive and award fees, which also typically tie to the contract type, may impact the costs that are passed on to the purchaser via the LOA.

AP7.C2.4.1.6. Contract terms and clauses, such as how the contract is to be financed (progress payments or Performance Based Payments (PBPs)) impact the timing of disbursements from the purchaser's trust fund in support of that contract.

AP7.C2.4.1.7. Contractor milestones have a direct relationship with LOA schedules. For example, does the contractor delivery plan coincide or conflict with the LOA delivery schedule? If a PBP is used, do the contractor payment milestones complement or conflict with the LOA payment schedule? If they conflict, revise the LOA payment schedule. Also, if the Estimated Availability Date comes after (exceeds/greater than) or does not coincide with the LOA delivery schedule, the LOA delivery schedule should be revised.

AP7.C2.4.1.8. Warranties implied or stated in the contract, or additional coverage purchased by the purchaser, represent a service on the FMS case. The line or line(s) into which the warranty is imbedded, is not considered Supply/Service Complete (SSC) until the warranty period expires. Prior to coding a line or case as SSC, the LOA should be reviewed for warranty note(s) to verify the warranty period.

AP7.C2.4.1.9. Contracts not yet closed out may necessitate an Unliquidated Obligation (ULO) value when the governing FMS case is ready for closure. The ULO represents the difference between obligations and articles/services disbursements. Many cases supported by open contracts may have no ULO at the time of case closure. The impact of a ULO on the closure type is discussed in Appendix 7, Chapter 3.

AP7.C2.4.1.10. Overhead rates apply to cost-type contracts. They are indirect costs incurred by a contractor while providing contract services. Contractors establish estimated overhead rates at the beginning of a fiscal year which are approved by the Defense Contract Management Agency (DCMA). At the end of the fiscal year, the contractor determines actual overhead rates. These must be audited by the Defense Contract Audit Agency (DCAA) and the contractor must make billing adjustments, as appropriate, based on DCAA's audit findings. Final overhead rates can take years to be audited and settled which can significantly impact the ability to close cases.

AP7.C2.4.2. Case Manager: Contracting Relationship. The outline of issues noted in Section 2.4.1. can be effectively addressed only when a relationship between the FMS CM and the contracting community exists. The contracting community includes the Program Manager (PM), Procuring Contracting Officer (PCO), Administrative Contracting Officer (ACO), Contracting Officer's Representative (COR), contractor, disbursing office, accounting office, foreign purchaser, DCMA and DCAA. This may be done in several ways, including involving the FMS CM with the PCO's team pre-award planning and building the statement of work/performance work statement and ensuring the CM understands post-award issues including the contract, contract modifications and links with financial systems. Specific facets of these relationships are identified below.

AP7.C2.4.2.1. Case Manager: Program Manager /Procuring Contracting Officer Relationship. The CM represents the end user (purchaser). The PM works in the USG program management office; the PCO typically works in the USG contracting/procurement office. This relationship provides a forum for resolution of LOA/contract discrepancies, comparison of documents, revision of purchaser requirements and notification of incentives, awards and accelerated delivery. In addition, the CM ensures the LOA events coincide with contract events, conducts program management reviews, revises the LOA as needed, based on discussions with the purchaser beforehand, and determines if there is a need for contract termination.

AP7.C2.4.2.2. Case Manager: Administrative Contracting Officer /Contracting Officer's Representative Relationship. The ACO and COR may be designated by the PCO; however, CM will ensure timeliness of receipt of final vouchers and contractor completion statements, timeliness and accuracy of contract modifications, audit requests and contract closeouts.

AP7.C2.4.2.3. Case Manager: Contractor Relationship. Focuses on contractor payment reconciliation (over and under payments) and contractor payment certification.

AP7.C2.4.2.4. Case Manager: Purchaser Relationship. Focuses on ensuring agreement on the LOA requirements, which in turn may translate into requirements on supporting funding documents (including contracts). This encompasses not only the LOA scope, but schedules, milestones and other case management components as well.

AP7.C2.4.3. Integrity of the Letter of Offer and Acceptance Document Compatibility with Actual Performance. Many critical relationships exist between the LOA pricing/development and LOA execution. Ensuring that the LOA continually represents an accurate picture of case execution performance is crucial for the management of an FMS case and to ensure that it moves to SSC in a timely manner. A number of the specific items to be reviewed in terms of comparing the LOA document with actual performance are captured in the Case Review and Reconciliation Matrix, Guidelines and Checklist (see Figures AP7.C2.F5., AP7.C2.F6. and AP7.C2.F7). Primary comparisons are listed below.

AP7.C2.4.3.1. Billings with how the items were priced, i.e., how the case was developed in the Defense Security Assistance Management System (DSAMS). The pricing methodology used to develop the case in DSAMS may differ from actual case execution.

AP7.C2.4.3.2. Payment schedule with expenditure rates.

AP7.C2.4.3.3. Lead-times/periods of performance/delivery commitment dates versus actual deliveries.

AP7.C2.4.3.4. Timelines for costs, for example, when were various rates in effect, versus cost assessments.

AP7.C2.4.3.5. Delivery reporting versus deliveries and billing of material and services.

AP7.C2.4.3.6. SOS codes versus execution, e.g., A SOS equal to "S" (stock) yet disbursements to contractors have been made.

AP7.C2.4.3.7. Generic code/Military Articles and Services List (MASL) used in case development (i.e., DSAMS) versus actual deliveries. This has Logistics Support Charge (LSC) implications for articles/services delivered between 1 Apr 1987 and 1 Oct 2007, when LSC was applicable.

AP7.C2.4.3.8. Scope with actual requirements submitted.

AP7.C2.4.3.9. Codes. Ensure Delivery Term Code (DTC), Delivery Source Code (DSC), Transportation Bill Code (TBC), Type of Assistance Code (TA) allows for proper case execution.

AP7.C2.4.3.10. Assessment of surcharges versus estimated values.

Figure AP7.C2.F5. Foreign Military Sales Case Review and Reconciliation Matrix

Figure AP7.C2.F6. Foreign Military Sales Case Review and Reconciliation Checklist Preparation Guidelines

Figure AP7.C2.F7. Foreign Military Sales Case Review and Reconciliation Checklist

This section outlines the requirement for the annual case review and reconciliations. All cases must be reviewed once per calendar year either on the anniversary of basic case implementation, in preparation for a formal review with the purchaser or when the case value adjusts by ten percent or more, thus requiring a Letter of Offer and Acceptance (LOA) amendment/modification. There are several items that must be reviewed for the annual case review, and there are also specified times in the case life cycle that each item must be reviewed. The Checklist (refer to Figure AP7.C2.F7.) and Checklist Preparation Guidelines (refer to Figure AP7.C2.F6.) are derived from the matrix. The Checklist also documents when the review was performed. The annual review and its retention are governed by the Foreign Military Sales (FMS) case file policies contained in the DoD Financial Management Regulation (DoD FMR). Each checklist shall be signed and dated by the case manager (CM) conducting the review and shall become an official document within the applicable case file. Electronic filing is both allowable and preferred whenever practical.

AP7.C2.5.1. Payment Schedule Updates. Updates to payment schedules are an integral part of keeping the purchaser informed of funding requirements during the execution phase of an LOA. These changes may be necessary to reflect revisions to delivery schedules (for example) and also adjusted scopes. For all cases not yet SSC, the payment schedule review occurs at least annually, and is one item found on the annual case review.

AP7.C2.5.2. Defense Security Cooperation Agency Oversight of Annual Case Reviews. DSCA will review a sampling of Annual Case Reviews on a quarterly basis, and additional cases may be reviewed during Business Process Reviews (BPRs) to ensure compliance. The number of samplings will be determined by the inventory of Implemented cases and further subdivided based on the ratio of the three age categories:

- Category 1: Cases Implemented for less than 2 Years;

- Category 2: Cases Implemented between 2-5 Years; and

- Category 3: Cases Implemented greater than 5 Years.

AP7.C2.5.2.1. DSCA will provide feedback and corrective actions if necessary as well as conduct trend analysis to identify any systemic issues requiring corrective action. DSCA will maintain a Master List of cases and results of the reviews for audit purposes.

An outcome of the review and reconciliation process for a given case may be the amendment or modification of a Letter of Offer and Acceptance (LOA). For example, it may be necessary to realign funds between lines on a case or among cases. Refer to SAMM Chapter 5 for guidance on LOA document preparation guidelines/policies, and SAMM Section C6.7. for guidance on determining when an amendment or modification should be used (in addition to guidance provided below for changes driven by reconciliation actions).

AP7.C2.6.1. Types Letter of Offer and Acceptance Modifications due to Case Reconciliation.

AP7.C2.6.1.1. Transferring Funds Among Letter of Offer and Acceptance Lines to Cover Expenditure Shortfalls not Resulting from Scope Changes. Modifications are required if, during reconciliation, expenditures exceed the LOA value. Modifications are not required during closure when final expenditures remain within or equal to the LOA total case value even though line items may be exceeded. The certificate of closure serves as the authorizing adjustment document in accordance with DoD Financial Management Regulation (DoD FMR), Volume 15, Chapter 3, Section 030902B.6.

AP7.C2.6.1.2. Adjusting Funding Levels on Line/Case Values to Reflect Actual Expenditures. When modifying the LOA value to realign funds, extreme care should be taken to ensure the requisite adjusted values for administrative surcharge, accessorials, Contract Administration Services (CAS) and Logistics Support Charge (LSC) are taken into consideration.

AP7.C2.6.1.3. Adjusting payment schedules.

AP7.C2.6.1.4. Adjusting prices.

AP7.C2.6.1.5. Lead time slippages.

AP7.C2.6.2. Letter of Offer and Acceptance Amendments due to Case Reconciliation. Reconciliation actions prompting an LOA amendment entail scope changes (e.g., extensions to performance periods). Scope changes also encompass adding or deleting requirements (except in preparation for case closure). The amendment may also capture changes shown in Section AP7.C2.6.1., to minimize the need to also process a separate LOA modification.

AP7.C2.7.1. Prevalidation requests are received daily for all contractor payments. The primary intent of the process is for Defense Finance and Accounting Service (DFAS) to ensure that sufficient obligations were previously recorded by the Implementing Agency (IA) in the Authorized Accounting system before a payment is made by the DFAS disbursing office to liquidate the obligation. In addition, liquidating progress payment transactions are also pre-validated to ensure that the outstanding progress payment balance in the IA accounting system is not over-liquidated. The ultimate goal of the process is to prevent Problem Disbursements (PDs), such as Unmatched Disbursements (UMDs) and Negative Unliquidated Obligations (NULOs).

AP7.C2.7.2. The process is based upon three transactions sent between the DFAS entitlement system and the IA accounting system. The Transaction '7' represents the Payment Authorization Request from the disbursing office, which includes the Contract/Reimbursable Document Number and request amount. The Transaction '8' is the Payment Authorization Response from the accounting system, containing an approval or denial code. The Transaction '9' is the Contract Payment Notification transaction, which is sent by the disbursing office at the time the payment is actually made (Refer to Figure AP7.C2.F8.).

AP7.C2.7.3. Payment Authorization Requests that are denied by the IA accounting system, must be researched by DFAS in consultation with the IA to determine the appropriate corrective action. The resolution could result in the cancellation of the Payment Request, or the posting of the correct obligation value to the IA accounting system so that the request can be approved.

Figure AP7.C2.F8. Prevalidation Chronology of Funds Flow

AP7.C2.8.1. Expenditure Authority (EA) is required before any disbursements (including reconciliation adjustments) are made against any case (Refer to Figure AP7.C2.F9.). For vendor payments, EA is requested as the payment voucher is processed, usually the day before the disbursement is made. An EA request checks "available cash" at country level (not case level) within the Foreign Military Sales (FMS) Trust Fund for sufficient funds to pay the invoice. The system moves the requested funds from "available cash" to "reserved cash" to cover pending disbursements. Disbursements are paid from the "reserved cash" account. When sufficient funds are not available, EA is not approved, and manual intervention occurs. If the purchaser has an account with a Federal Reserve Bank (FRB), then Defense Finance and Accounting Services - Indianapolis (DFAS-IN)may make an Out of Cycle Drawdown from that account. If not, DFAS-IN may request additional payment from the purchaser or take other appropriate action. DFAS-IN reconciles EA with disbursements each month-end.

Figure AP7.C2.F9. Cash Management Disbursing Office Expenditure Authority Process

AP7.C2.9.1. Financially Troubled Case. This condition results when commitments, obligations and/or expenditures exceed Obligational Authority (OA) issued.

AP7.C2.9.1.1. Overcommitted. A case is overcommitted when commitments posted exceed OA. Solutions to overcommitment include validating the OA value, validating commitments with actual funding documents, validate that all requirements are established, ensuring duplicate requirements are not established, and ensuring a requirement is not established as both direct cite and reimbursable. If commitments are valid additional OA or an OA revision may be requested. In this situation, a case/line increase may be required as well.

AP7.C2.9.1.2. Overobligated. A case is overobligated when obligations posted exceed OA. Solutions to overobligated funds are to validate the OA value, validate obligations with actual funding documents, validate that all requirements are established, and ensure duplicate requirements are not established. If obligations are valid, the case manager (CM) processes a case/line increase.

AP7.C2.9.1.3. Overexpended. An overexpended condition occurs when the total expenditures posted exceed OA. An overexpended condition may be a result of when expenditures are posted erroneously to the wrong country/case; credit charges have not yet processed; when unprocessed financial exceptions exist; or when improperly applied expenditures may have processed. If expenditures are valid, request available OA; adjust available OA; or request additional OA via Letter of Offer and Acceptance (LOA) Amendment. All Financially Troubled Cases (FTCs) must be corrected prior to case closure.

AP7.C2.9.2. Adverse Financial Condition. Adverse financial conditions occur when OA exceeds case or line item level values; commitments or obligations exceed OA at case or line item level; total disbursements exceed obligations at case or line item level; or Expenditure Authority (EA) is not requested prior to disbursing. The Implementing Agency (IA) has the responsibility to resolve adverse conditions involving obligations or expenditures in excess of approved authority at any level lower than case level as soon as the condition is identified. An Adverse Financial Condition (AFC) is generally resolved by ensuring all obligations for the case are posted properly and that all posted expenditures belong to that particular case. This condition is addressed in DoD FMR Volume 15, Chapter 3, Section 031102 as well as in the SAMM Section C16.2.7.

AP7.C2.9.3. Anti-Deficiency Act. Refer to DoD FMR Volume 15, Chapter 3 Section 031101 and Volume 14, Chapter 2 for a discussion on the conditions, remedies and penalties regarding the Anti-Deficiency Act (ADA).

AP7.C2.10.1. Definition. A Problem Disbursement (PD) is a transaction reported to the Treasury Department's Bureau of Fiscal Services, but upon receipt at the official accounting station cannot be successfully matched to the original obligation or accounts receivable amount for liquidation purposes. PDs include Unmatched Disbursements (UMDs), Negative Unliquidated Obligations (NULOs), and in-transit disbursements made by disbursing officers. For purposes of this guide, PDs are classified into two categories – UMDs (to include in-transits) and NULOs.

AP7.C2.10.2. Resolution Timeline. In total, Defense Finance and Accounting Service (DFAS) and the activity issuing the contract/funding document have 120 days to research and correct UMDs/NULOs. When the issuing activity and their accounting office are co-located, the research period is limited to 91 days (Refer to Table AP7.C2.T2. "Timeline for Problem Disbursement review and Resolution" and Figure AP7.C2.F10.). During the first 60 days, the Implementing Agency (IA)/DFAS shall research and record obligations if documentation is held. DoD policy states that beginning 1 Apr 2002, if the issuing activity has failed to record the obligations within 120 days after the UMD or NULO has occurred, if DFAS holds a copy of the obligating document they must record the obligations.

AP7.C2.10.3. Write-off Authority. IAs/Defense Finance and Accounting Services - Indianapolis (DFAS-IN) has the authority to write off unresolvable PDs of up to $2,500 per transaction. PDs greater than $2,500 per transaction shall be referred to the DSCA Comptroller for resolution in accordance with DoD FMR Volume 3, Chapter 11.

AP7.C2.10.4. Impact on Closure. All PPDs must be cleared prior to closure, regardless of closure type.

Table AP7.C2.T2. Timeline for Problem Disbursement Review and Resolution

Days | Responsibility | Action |

|---|---|---|

0 – 60 | IA/DFAS-IN | Research PD. Clear UMD/NULO or record valid obligations if documentation held. |

61-120 (61-90 if co-located) | Issuing Activity | Research PD. Clear UMD/NULO or record valid obligations if documentation held. |

121 (91 if co-located) | DFAS-IN | Record obligations or use write-off authority to liquidate PDs. |

Figure AP7.C2.F10. Problem Disbursement Resolution Process

AP7.C2.10.5. Unmatched Disbursements. Disbursements are submitted to the IA for material, training or services and become a problem when there is missing or inaccurate information on record fields, such as, Accounting Activity (AA), Appropriation Symbol and/or Appropriation Subhead that does not match to the correct detail obligation recorded in the IA accounting system. This includes transactions that are rejected back to the paying office or central disbursement clearing organization by an accounting office. The problem disbursement cannot properly match to a valid obligation at the country level, country/case level or at the contract/requisition/Accounting Classification Reference Number (ACRN) level. PDs can be related to contracts, reimbursable documents, travel records, or interfund transactions from the DoD defense supply activities, such as the Defense Logistics Agency (DLA) or the General Services Administration (GSA).

AP7.C2.10.5.1. Researching Unmatched Disbursements. Information found on Letters of Offer and Acceptance (LOAs), Defense Cash Accountability System (DCAS), vouchers, contracts, payment histories, Mechanization of Contract Administration Services (MOCAS), Defense Integrated Financial System (DIFS), IA or other systems should be verified. Research may uncover missing information about the problem disbursement or confirm how the disbursement can be modified. This research can then be accurately applied to a valid existing obligation to expedite disbursement processing.

AP7.C2.10.6. Negative Unliquidated Obligation. A NULO occurs when a disbursement transaction has been matched to the cited detail obligation, but the total disbursement(s) exceed(s) the amount of that obligation. A Negative Unliquidated Obligation (NULO) may or may not cause an Adverse Financial Condition (AFC)/Financially Troubled Case (FTC) condition, depending upon whether the NULO causes total expenditures to exceed obligations/Obligational Authority (OA) at the case level. In addition, a NULO may or may not cause an Anti-Deficiency Act (ADA) violation. If the NULO is caused by an overpayment to a contractor, refer to the procedures contained in the DoD Financial Management Regulation (DoD FMR), Volumes 4, 5, 10 and 15. NULOs preclude case closure.

AP7.C2.10.7. Vouchers. This form is used to move disbursement transactions from one case/line item to another as well as correct erroneous disbursement information.

AP7.C2.10.7.1. Standard Form 1080 ("Voucher for Transfers between Appropriations and/or Funds"). This form is used to expend orders for which the source of supply has not sent a bill. (Form: SF 1080)

AP7.C2.10.7.2. Standard Form 1081 ("Voucher and Schedule of Withdrawals and Credits"). This form is used to move disbursement transactions from one case/line item to another as well as correct erroneous disbursement information. (Form: SF 1081)

AP7.C2.10.8. Contract Overpayments.

AP7.C2.10.8.1. The timeline for resolution of NULOs does not apply if the NULO was caused by a contract overpayment. Policies and procedures for collection of commercial or contractor debt are covered in the DoD FMR (Volume 10, Chapter 18). In addition, the Federal Acquisition Regulation (FAR) subpart 32.6. prescribes policies and procedures for ascertaining and collecting contract debts.

AP7.C2.10.8.2. When a NULO is determined to be an overpayment, the applicable Accounting/Finance Branch forwards a Debt Package to the original disbursing office (e.g., Defense Finance and Accounting Service (DFAS) Columbus) and records the NULO as a contract overpayment. Upon determination that a debt exists from a contractor, the disbursing office issues a demand letter. Disbursing Officers are the officials designated responsible for issuing a demand letter. The demand letter shall direct the contractor to make payment for the debt to the disbursing office.

AP7.C2.10.8.3. Based on the statute of limitation, agencies are barred from filing a formal complaint to pursue a collection action until after the expiration of the later of the following dates: six years from the debt repayment due date, or within one year after a final decision has been rendered in an administrative proceeding. Administrative offsets of payments may continue for up to 10 years. Accordingly, the collection of contractor debts should be pursued in accordance with the time limitations specified in 28 U.S.C. 2415 and 31 U.S.C. 3716.

AP7.C2.11.1. Monthly Reporting. The Implementing Agency (IA) systems report performance to Defense Integrated Financial System (DIFS) for Foreign Military Sales (FMS) cases representing the cost of the FMS materials and services and work in process. DIFS executes two performance cycles each month, except for one cycle in months when the Defense Department DD Form 645 is produced. Performance updates DIFS and processes to the purchaser's quarterly DD Form 645 bill. The performance feedback is transmitted from DIFS to the IA accounting systems via Positive Transaction Control (PTC). Table AP7.C2.T3. shows the types of performance transactions that are sent from the IAs to DIFS:

Table AP7.C2.T3. Performance Reporting

Performance | Description Of Performance | Defense Integrated Financial System Updates |

|---|---|---|

'NA' | Delivery reporting based on final expenditure processing | Delivered Articles and Services including:

|

'ND' | Progress payment or partial, incremental billing | Progress Payment Reported, which includes CAS, if charge is Sec 22 |

'NX' | DDelivery reporting for percentage-based accessorial charges such as packing, crating, handling, and transportation (PCH&T) | Accessorial Costs |

'NZ' | Delivery transaction codes with an Adjustment Reply Code (ARC) for Supply Discrepancy Report (SDR) financial adjustment. | Delivered Articles and Services including:

|

AP7.C2.11.1.1. Delivery Source Code. The Delivery Source Code (DSC) represents the type of reporting based on material/services supplied. Refer to the DoD Financial Management Regulation (DoD FMR), Volume 15, Chapter 8 for a complete list of DSCs. The DSC determines where the delivery should be posted in DIFS Section 21 or Section 22 and provides an audit trail between performance and the pricing of the Letter of Offer and Acceptance (LOA). The DSC is used by DIFS to assess add-on costs for surcharges.

AP7.C2.11.1.2 Reimbursement Code. The codes in Table AP7.C2.T4. are used by Defense Finance and Accounting Services – Indianapolis (DFAS-IN) to determine the reimbursable status of the transaction. Reimbursement codes determine where the delivery is posted in DIFS Section 21 or Section 22, liquidating or non-liquidating.

Table AP7.C2.T4. Reimbursement Codes

Code | Definition |

|---|---|

D | Non-liquidating for contracts |

I | Interfund reimbursement to DoD supply activities |

M | Miscellaneous receipts |

N | Liquidating, also updates progress payments |

R | Reimbursable |

S | Reimbursement to DoD supply activities (may or may not be interfund) |

AP7.C2.11.1.3 Price Code. The price codes in Table AP7.C2.T5. identify the delivery report as a charge to work in process, a physical delivery or performance of requested DoD services.

Table AP7.C2.T5. Price Codes

Code | Definition |

|---|---|

Blank | No CAS is applicable; progress payment |

A | Delivery is at actual costs |

E | Delivery is at an estimated price; actual cost to be reported at a later date |

N | Indicates progress payments or CAS needs to be charged |

AP7.C2.11.2. Constructive Delivery Reporting. This is the reporting of quantities of items on LOA lines having a unit of issue of each for the generic codes listed below. DoD components must report within 30 days of title transfer to the purchasing country, constructive deliveries to DFAS-IN in the 'C1' constructive delivery transaction format. These transactions are not part of the formal FMS billing system.

AP7.C2.11.2.1. The following generic codes apply:

AP7.C2.11.2.1.1. Generic codes A1 through A5 and A9B (Aircraft).

AP7.C2.11.2.1.2. Generic codes B1 through B4 (complete missile lines only).

AP7.C2.11.2.1.3. Generic code C (Ships).

AP7.C2.11.2.1.4. Generic code D (Combat Vehicles).

AP7.C2.11.2.1.5. Generic code E3 (Tactical and Support Vehicles).

AP7.C2.11.2.1.6. Generic codes F2 through F4 (Weapons).

AP7.C2.11.2.1.7. Generic codes G2, G4, G5 (less M and Y) and G6A (Ammunition).

AP7.C2.11.2.1.8. Generic code H4 (Communications Equipment).

AP7.C2.11.2.2. The 'C1' constructive delivery transaction format is provided in Table AP7.C2.T6.

Table AP7.C2.T6. 'C1' Constructive Delivery Transaction Format

Column(S) | Data Element |

|---|---|

1-2 | C1 |

3-4 | Country Code (CC) |

5 | IA |

6-8 | Case Designator |

9-11 | LOA Line Number/Record Serial Number |

12-15 | Blank |

16-21 | Cumulative Quantity Delivered to Date |

22-72 | Blank |

73-78 | Reporting Date (YYMMDD format) |

79 | Blank |

80 | Originator (always an 'A') |

Foreign Military Sales (FMS) surcharges consist of Administrative, Contract Administration Services (CAS), Logistics Support Charge (LSC) and Accessorials, such as packing, crating, handling, and transportation (PCH&T). The Surcharge Matrix in the DoD Financial Management Regulation (FMR), Volume 15 Chapter 8 contains a list of Delivery Source Codes (DSCs) and whether surcharges apply.

AP7.C2.12.1. Administrative Surcharge. The administrative surcharge is applied by the USG to recover costs for administering the FMS program. Refer to the following for additional information: Arms Export Control Act (AECA); DoD FMR, Volume 15, Chapter 7; and SAMM Section C9.4.7.

AP7.C2.12.1.1. Business Rules. The administrative surcharge is included as a below-the-line charge on the Letter of Offer and Acceptance (LOA). Administrative surcharge rates vary depending on implementation date of the individual LOA line and whether the line is for standard items, non-standard items, program management, or certain types of training (Refer to SAMM Table C9.T4. for more information).

AP7.C2.12.1.2. Small Case Management Line. From August 1, 2006 through July 2, 2012, the DSCA implemented an effectiveness measure to reduce the volume of small dollar cases through the application of a Small Case Management Line (SCML) to LOAs. If the case value was so small that the FMS Administrative Surcharge amount calculated was less than $15,000, a separate line item (an SCML) was added to the case so that the FMS Administrative Surcharge and the SCML, combined, totaled $15,000. With the rescission of SCML policy, an SCML will never increase. However, it can decrease to zero as the case value increases. The SCML value should be included in the certified delivered value; but, not in the certified disbursement value. For additional information on case closure requirements for SCMLs, refer to SAMM Section C9.4.7.5.

AP7.C2.12.2. Contract Administrative Services. CAS is a surcharge applied by the USG for: (1) quality assurance and inspection, (2) contract audit and (3) contract administration. Some countries have a CAS waiver; (Refer to SAMM Tables C9.T5. through C9.T7.). Waivers are based on the AECA and international agreements. CAS is initially priced on the LOA during its development. Ensuring accurate accounting for CAS is a key component in case reconciliation. The DoD FMR, the SAMM and the Security Cooperation Billing Handbook should be consulted for additional information.

AP7.C2.12.2.1. Business Rules. FMS CAS rates vary depending on the implementation date of the basic (new) LOA. Refer to SAMM Table C9.T4. for a description of all CAS rates. Defense Security Assistance Management System (DSAMS) contains various notes to cover specific CAS pricing application. These notes are required on ALL basic cases, amendments or modifications that contain either an 'X' or 'P' in Source of Supply (column 5) of the LOA. CAS is applied in DSAMS to contract primary cost components that relate to primary element code of 'CC' (Refer to Figure 2.F11.). The total CAS percentage applied is reflected on the Defense Integrated Financial System (DIFS) (FIC1) Case Control Summary Data Screen (Refer to Figure 2.F12.).

Figure AP7.C2.F11. Contract Administrative Services Letter of Offer and Acceptance Development Cycle

AP7.C2.12.2.2. The annual case review matrix and checklists include a requirement to validate CAS pricing accuracy (See Figures AP7.C2.F5., AP7.C2.F56. and AP7.C2.F7.). This entails ensuring a linkage exists between actual CAS-related execution performances with the current CAS pricing profile as contained in DSAMS. The annual review may necessitate adjustments to the DSAMS CAS pricing structure and issuance of a corresponding LOA modification.

AP7.C2.12.2.3. Contract Administrative Services Performance Transactions.

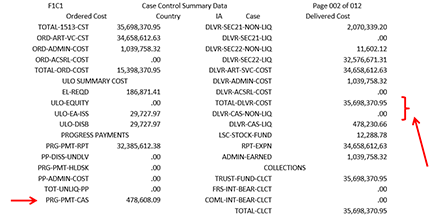

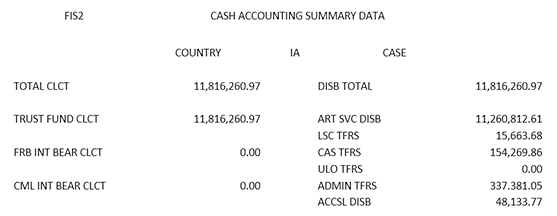

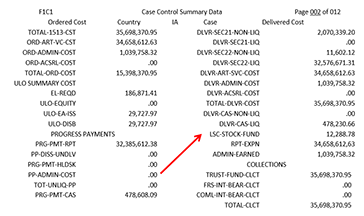

AP7.C2.12.2.3.1. CAS shows in DIFS FIC1 as PRG-PMT-CAS. During active case execution, DIFS applies CAS costs to incoming IA 'ND' performance transactions. CAS values show in DIFS FIC1 under three categories: PRG-PMT-CAS (resulting from 'ND' transactions); Delivered CAS Liquidating and Delivered CAS Non-Liquidating (resulting from internal DIFS transactions based on 'ND' transactions). CAS costs are also included in the Delivered Articles and Services value in DIFS. CAS also posts to DLVR-CAS-LIQ and DLVR-CAS-NON-LIQ amount (See Figure AP7.C2.F12.). Refer to Figure AP7.C2.F13. for a sample DIFS Cash Accounting Summary Data Screen (FIS2). This screen displays the surcharge amounts disbursed.

Figure AP7.C2.F12. Contract Administrative Services Amounts on Defense Integrated Financial System Case Control Summary Data Screen (FIC1)

Figure 2.F13. Defense Integrated Financial System Surcharges Shown on Cash Accounting Summary Data Screen (FIS2)

AP7.C2.12.2.3.2. Reconciliation of Contract Administrative Services. If during the annual case review, actual exceeds estimated CAS by the greater of 10% or $200, a reconciliation of CAS must be conducted. A validation of appropriation codes, delivery source codes, price codes and reimbursement codes identifies applicable CAS. A case modification may be required to adjust estimated CAS.

AP7.C2.12.3. Logistics Support Charge. LSC is defined as the assessment of a 3.1% surcharge of the material value intended to recover the cost of logistics support involved in providing the spares and other items required to maintain a weapon system. These costs represent production controls, requisition processing, inventory management and logistics management.

AP7.C2.12.3.1. Business Rules.

AP7.C2.12.3.1.1. Defense Finance and Accounting Services - Indianapolis (DFAS-IN) applies LSC to delivery costs for those lines in FMS cases that have been identified as support lines, based on the Military Articles and Services Lists (MASLs) included in the LOA.

AP7.C2.12.3.1.2. Generic codes for which LSC applies are found in the DoD FMR Volume 15, Chapter 7, Sections 0722 through 072205.

AP7.C2.12.3.1.3. LSC applies to items cited in Section AP7.C2.13.2.1. that were shipped on or after 1 April 1987 and before 1 Oct 2007, except for generic codes B1 through B3.

AP7.C2.12.3.1.4. LSC applies to generic codes B1 through B3 for items shipped after 1 Feb 1992 and before 1 Oct 2007. LSC does not apply to material funded by Defense Working Capital Funds (DWCF) with a pricing code of 'SR' and 'SF', shipped after 1 Oct 1990 since it is included in the price of the material. DSCs for DWCF that are exempt from LSC are: AA, AB, AC, AD, AH, AJ, AK, CA, and SA. These relate to pricing elements SR and SF with financing appropriation 97X4930 DBOF/WCF.

AP7.C2.12.3.1.5. LSC only applies to 'NA' delivery transactions. It never applies to 'ND' transactions.

AP7.C2.12.3.1.6. LSC is reflected in DIFS Delivered Articles and Services.

AP7.C2.12.3.2. Reviewing Logistics Support Charge. As cited above in Sections AP7.C2.12.3.1.3. and AP7.C2.12.3.1.4., the date of shipment affects the calculation of LSC. The DIFS FIC1 query identifies LSC in the field "LSC-STOCK-FUND". This field reflects costs for both LSC and Stock Fund Add-On (1980-1982). It can also be found using the DIFS FIS2 Cash query (LSC TFRS). To verify LSC, using the DIFS FIC1 "DLVR-ART-SVC-COST" field, subtract "LSC STOCK FUND" and CAS in order to equal IA expenditures. IA expenditures are verified by subtracting CAS, LSC and Stock Fund Add-On costs from DLVR-ART-SVC-COST. In addition to LSC, cases implemented prior to April 1987 may include a Stock Issue Asset Use (SIAU) charge. This charge is included on the DIFS FIC1 query "LSC-STOCK-FUND" (Refer to Figure AP7.C2.F14.) Unlike LSC, which is subtracted from the "DLVR-ART-SVC-COST" to determine IA expenditures, SIAU is added to the IA expenditures to equal "DLVR-ART-SVC-COST".

Figure AP7.C2.F14. Defense Integrated Financial System Case Control Summary Data Screen (FIC1)

AP7.C2.12.4. Accessorials. These include packing, crating and handling (PC&H) and "below-the-line" transportation. The appendices in the Security Cooperation Billing Handbook (commonly referred to as the "Red Book") contain a wealth of information regarding the accessorial charges to help during case development and reconciliation.

AP7.C2.12.4.1. Packing, Crating and Handling. The labor, material and service costs related to preparing items for shipment to purchasers.

AP7.C2.12.4.1.1. Packing, Crating and Handling Policy. The DoD FMR Volume 15 and SAMM Chapter 9 cite the guidelines for assessing PC&H charges.

AP7.C2.12.4.1.2. Business Rules. PC&H is usually, but not always, a "below-the-line" accessorial cost and not part of the material value of the FMS case. PC&H charges are included in the accessorials on the DIFS FIC1 query.

AP7.C2.12.4.1.3. The DSC for non-General Services Administration (GSA) PC&H is 'AE'.

AP7.C2.12.4.1.3.1. The DSC for GSA PC&H is 'EF'. GSA prescribes its own rates for PC&H applicable to items shipped by GSA.

AP7.C2.12.4.1.3.2. For contract material, PC&H is included in the price of the material.

AP7.C2.12.4.1.3.3. For DWCF material shipped 1 Oct 1990 and subsequent, PC&H is included in the price of the material.

AP7.C2.12.4.1.4. Calculating Packing, Crating and Handling. When it is an accessorial, PC&H equates to 3.5% of the first $50,000.00 of the material value, plus 1% of value above $50,000.00. When it is a separate line on the LOA (i.e., above-the-line cost), the Line Manager determines the PC&H value to be charged. In this instance, PC&H is NOT considered an accessorial.

AP7.C2.12.4.2. "Below-the-Line" Transportation. The cost to ship material to purchasers.

AP7.C2.12.4.2.1. Transportation Policy. Refer to the DoD FMR Volume 15, the SAMM and the DoD 4500.9-R Part II "Cargo Movement" for transportation policy and guidelines.

AP7.C2.12.4.2.2. Business Rules.

AP7.C2.12.4.2.2.1. Transportation costs are estimated during case development and are considered below-the-line accessorial costs, or below line '8' on the LOA.

AP7.C2.12.4.2.2.2. The Delivery Term Code (DTC) is the initial indicator of transportation costs. It specifies the planned transportation arrangements for delivering material to the purchaser (See the DTC tables and rates in DoD FMR Volume 15).

AP7.C2.12.4.2.2.3. Transportation Bill Code (TBC) is used to override the DTC or when no DTC was provided on the requisition. It is not part of the requisition document number. The override is used to charge an amount different from that computed by the DTC and documents the actual transportation method used for that requisition. See the TBC definitions and rate table in DoD FMR Volume 15, Chapter 8, Tables 8-1, 8-2 and 8-3.

AP7.C2.12.4.2.2.4. For DWCF material shipped 1 Oct 1990 and subsequent, inland transportation costs (generic code L1A) are included in the price of the material.

AP7.C2.12.4.3. Transportation Cost Look-Up Table. The purpose of the Transportation Cost Look-Up Table (TCLT) is to provide applicable DoD components estimated actual transportation costs for items normally shipped in the Defense Transportation System (DTS), e.g., sensitive/hazardous end items, or when costs using standard transportation percentages are significantly different from actual charges. Procedures and guidelines for use of the TCLT are in the SAMM Appendix 2.

AP7.C2.12.4.4. Above-the-Line Transportation. For shipments related to USG or contractor furnished material to another USG agency or contractor, special Transportation Account Codes (TACs) are used. Refer to the DoD 4500.9-R Part II, Cargo Movement, Appendix V "TAC Policy and Procedures" and Appendix V7 for Security Assistance Program Shipment TACs.

All cases and lines will eventually transfer to Supply/Services Complete (SSC) status. The reconciliation condition of data (other than that which is preventing item delivery or actual completion of services), the allocation of resources (funding and/or manpower), or the distribution/transfer of workload are not factors in determining when SSC occurs. The process for determining if a case or line is SSC is found in Figure AP7.C2.F15. and Figure AP7.C2.F16.

AP7.C2.13.1. The Implementing Agency (IA) declares a case or line is SSC when the following events occur by updating the status in the IA system (to include SSC Date) and informing the purchaser:

AP7.C2.13.1.1. All items are delivered; title has transferred.

AP7.C2.13.1.2. Verification that all services have been performed.

AP7.C2.13.1.2.1. Training. Verification that all courses, Mobile Training Teams (MTT) and Extended Training Service Specialist (ETSS)/Language Training Detachments(LTDs) are completed, all Temporary Duties (TDYs) are finished, and all case-funded salary positions have expired.

AP7.C2.13.1.2.2. Program Management Line. The end point may vary but may be no later than 12 months after final delivery and/or performance of last non-Program Management Line (PML) service for the related case(s). Like any other service, the duration of PML must be linked to the period of performance.

AP7.C2.13.1.3. All warranty periods have elapsed.

AP7.C2.13.1.4. No items are in storage.

AP7.C2.13.1.5. If the country is under suspensions and/or sanctions, there are no deliveries pending, and no future deliveries shall occur once sanctions are lifted.

AP7.C2.13.2. Supply/Services Complete Coding. Once the conditions for SSC are reached, lines and/or cases are coded by the IA with this status and the actual date of SSC within 5 business days in the appropriate security cooperation information management systems. To the extent possible, the SSC status of lines and sublines should be coded in the Defense Security Assistance Management System (DSAMS) as either completed (CMPLTD) or shipped (SHPD) as another means of informing the purchaser of general order status. For a document in development, the SSC status can be updated by placing the line or subline in an 'edit' status and selecting one of the options from the pick list. The SSC status can also be updated on the "I" version using the restricted tools/update implemented case function. As cases enter SSC, the DSCA (OBO/FPRE) Country Finance Director (CFD) will post the CLOSHOLD milestone in DSAMS to prevent the creation of new amendments, modifications, and/or revisions to the case. Should an IA identify the need to process an amendment or modification to a case with the CLOSHOLD milestone, in support of final reconciliation for closure, the IA must request the temporary removal of the milestone. The request, including a detailed justification for the amendment or modification, must be submitted to DSCA. The DSCA CFD will review the request and, upon approval, will temporarily remove the milestone to allow for the required case action, after which time the milestone will be reapplied to continue the closure process.

AP7.C2.13.3. Supply/Services Complete Case Reductions. Upon SSC, the IA is responsible for reviewing the case to determine if a modification to reduce the case value is required (refer to SAMM Section C16.2.13. for related policy and exceptions). The reduction requirement determination will be based the minimum amount the IA considers is required to cover current, actual cost and any projected, reasonable amount necessary to cover potential adjustments that may be found during SSC reconciliation in preparation for case closure, to include below-the-line costs. This amount is the Adjusted SSC Value (ASSV). The ASSV is used to determine the residual value on the case by subtracting the ASSV from the existing case value. If the Foreign Military Sales (FMS) case has residual value less than the amounts in Table AP7.C2.T7., or if case is expected to close within six months after SSC, then the purchaser does not need to be contacted as excess value will be drawn down at case closure. However, if the FMS case has residual value that equals or exceed the amounts in Table AP7.C2.T7., then the purchaser should be contacted regarding their options, which include closing the FMS case, preparing a Modification to reduce the FMS case value, or adding the FMS case to the "Keep Open" list for new requirements that will be forthcoming. Follow-up should occur every 60 days until resolution is reached. Completing SSC reconciliation is not expected or necessary to determine the ASSV or to prepare a case reduction. Case reductions must either cover the highest financial requirement (HFR) at the line level as indicated in the appropriate security cooperation management and accounting systems or an amount below the line level HFR must be explained sufficiently in the IA comments section of the Letter of Offer and Acceptance (LOA) Checklist. Examples of such comments include those such as "pending accounting system update anticipated in the next 30 days" or "pending the next performance interface to Defense Integrated Financial System (DIFS)".

Table AP7.C2.T7 – Thresholds for Supply/Services Complete Case Reductions

Existing Case Value | Residual Case Value |

|---|---|

$1- $499,999 | $10,000 or greater |

$500,000 – $999,999 | $25,000 or greater |

$1,000,000 - $4,999,999 | $50,000 or greater |

$5,000,000 - $9,999,999 | $75,000 or greater |

> $10,000,000 | $100,000 or greater |

AP7.C2.13.4. "To Be Kept Open" List. If the purchaser indicates the intent is to execute the residual value of the FMS case, the IA will include it on the "To Be Kept Open" list upon written notification from the LOA signatory organization until requirements are identified to use the residual FMS case value. At that time, the IA will remove the SSC status on the FMS case and remove it from the "To Be Kept Open" list. Until the case is removed from the "To Be Kept Open" list, the IA should follow-up every 60 days with the purchaser and provide DSCA the current status through the quarterly case closure status reporting process. If disposition of the residual case value has not occurred after 180 days, the case should be removed from the "To Be Kept Open" list and a modification to the LOA prepared to return the residual case value. FMS Cases can be added to the list for other conditions such as DSCA-approved, purchaser-unique Unliquidated Obligation (ULO) closure thresholds. FMS cases added to the list for other conditions should be reviewed every 90 days to determine if they should remain on the list.

Figure AP7.C2.F15. Supply Services Complete Process

Figure AP7.C2.F16. Line Item Supply Services Complete Process

AP7.C2.14.1. The Figure AP7.C2.F17. shows the primary systems interfaces. Refer to Table AP7.C2.T8. for further information.

Figure AP7.C2.F17. Systems Interfaces

AP7.C2.14.2. Table AP7.C2.T8. shows system interfaces that occur during active case reconciliation:

Table AP7.C2.T8. Systems Interfaces

Click to view:

AP7.C2.15.1. The manpower funding guidelines in Table AP7.C2.T9. pertain to active case reconciliation efforts:

Table AP7.C2.T9. Active Case/Execution Phase Reconciliation Manpower Funding

Reconciliation Function | Funding Source |

|---|---|

Financial and logistical reconciliation until the case becomes Supply/Services Complete (SSC) | FMS Administrative surcharge-Program Element (PE) 13 up to six months post-SSC. However, a Program Management Line (PML) can be the funding source if one exists. In other words, a PML cannot exist solely to reconcile a case. |

Expedited reconciliation efforts requested by the purchaser beyond normal financial management standards. | A line on a new or existing case is preferred, although a line on the case being reconciled could be used as well. |

AP7.C2.16.1. Table AP7.C2.T10. shows the primary points of contact (POCs) for active case reconciliation.

Table AP7.C2.T10. General Point of Contact Matrix

Organization | Office |

|---|---|

DSCA (Financial Policy & Regional Execution) | DSCA (Office of Business Operations, Financial Policy & Regional Execution Directorate (OBO/FPRE)) |

Army | United States Army Security Assistance Command (USASAC) New Cumberland (AMSAC-LAL-PCS) |

Navy | NAVY International Programs Office (IPO) (230-F) |

Air Force | AFLCMC/WFCQ |

Defense Finance and Accounting Services - Indianapolis (DFAS-IN) | DFAS-IN/JAX |

Defense Contract Management Agency (DCMA) | DCMA-Financial and Business Office |

AP7.C2.17.1. Purpose. The Military Interdepartmental Purchase Request (MIPR) is a request for goods or services from another military organization. In addition, some Military Departments utilize MIPRs for internal purchases. (Refer to Figure AP7.C2.F18.). The MIPR does not redistribute funds from one organization to another, but provides a fund cite so that goods or services may be provided or procured. The Defense Department (DD) Form 448 is completed in two parts, the request and the acceptance. It must contain a brief description of why the funds are being provided and when the performance is expected (purpose and period of performance). MIPRs may be used for reimbursement authority, direct cite authority, or a mixture of both. The funds certifier shall process the commitment into the financial system.

AP7.C2.17.2. Process. The requesting activity or holder of the funds shall initiate the DD Form 448. The approving authority shall sign their name, assign a MIPR number and ensure that funds are committed. The form is then forwarded to the performing activity. The performing activity shall complete (including technical and financial point of contact (POC), phone number, email) and sign the MIPR Acceptance (DD Form 448-2) (Refer to Figure AP7.C2.F19.). By accepting the MIPR as a reimbursable document, the performing activity shall provide the goods or services with its own appropriation and bill the requester for reimbursement. The MIPR itself is then obligated in the accounting system. By accepting a MIPR as a direct cite document, the performing activity shall purchase the goods or services utilizing the fund cite on the MIPR. The funding cites on the MIPR and funding document must match. The performing activity must provide copies of the associated funding document to the requesting activity, to record the obligation in the accounting system. An Unmatched Disbursement (UMD) may result if this is not done. If the DD Form 448 is returned to the requesting activity without acceptance, the performing activity shall not provide the goods or services. In this instance, the corresponding commitment previously established in the accounting system must be removed. The accepted DD Form 448-2 is then sent back to the requesting activity.

AP7.C2.17.2.1. For reimbursable MIPRs, the requesting activity, resource manager or Defense Finance and Accounting Service (DFAS), as appropriate, changes the commitment to an obligation upon receipt of MIPR acceptance. For direct cite, the obligation occurs when the associated funding document is received by the requesting activity. Once the goods or services are provided, the performing activity prepares an invoice and sends it to the disbursing office for processing. Failure to do so may result in a financially troubled case (FTC)/problem disbursement (particularly unmatched disbursement) status. Prior to incurring the related expenditure, the performing activity shall request additional funding, if needed. Likewise, the performing activity shall advise the requesting activity if the funding amount exceeds the cumulative costs for projected or actual requirements. Ninety (90) days after the work completion date, the requesting activity shall seek shipping/service confirmation (e.g., DD Form 250, DD Form 1348-1A SF1080), other written confirmation and billing data (e.g. Standard Form SF1080, performance transactions, copies of final invoices) if not received. DFAS shall process the billings against the obligation set up in the accounting system.

AP7.C2.17.2.2. Other information regarding MIPR procedures include the requesting activity preparing the acceptance DD Form 448-2 along with the MIPR to assist the performer in accepting the MIPR faster. The DD Form 448-2 should be sent from the performing activity to the requesting activity within 60 days of receiving the associated DD Form 448. While an Unliquidated Obligation (ULO) may exist on a MIPR for an Accelerated Case Closure Procedure (ACCP) case that is being interim closed, liquidation of the MIPR prior to closure is preferred. Liquidation of the MIPR is mandatory prior to closing a non-ACCP case. When the final billing is received and the total amount of the invoice is less than the unliquidated obligation set up in the accounting system the requesting activity, the resource manager or DFAS, as appropriate, shall deobligate any excess funds after a complete validation of the obligation.

AP7.C2.17.3. Additional directives and resources regarding the MIPR process, accounting rules, Economy Act Order issuance in accordance with 31 U.S.C. 1535, and Project Order issuance in accordance with 41 U.S.C. 6307 include DoD FMR, Volume 3, Chapter 8, Volume 11a, Chapters 1, Volume 11a, Chapter 3, and Defense Federal Acquisition Regulation Supplement (DFARS) Subparts 208.70, 208.7004., and 253.208.

Figure AP7.C2.F18. DD Form 448: Military Interdepartmental Purchase Request

Figure AP7.C2.F19. DD Form 448-2: Acceptance of Military Interdepartmental Purchase Request