Appendix 8 - Special Defense Acquisition Fund

SDAF

SA

No

Permanent

22 U.S.C. 2795, 10 U.S.C. 114(c), and Annual Department of State Foreign Operations and Consolidated Appropriation Act

Global

Provides:

- Defense Articles

- Defense Services

SDAF.1.1. The Special Defense Acquisition Fund (SDAF) is a revolving fund that is used by the Secretary of Defense (SECDEF), in consultation with the Secretary of State (SECSTATE), to finance the procurement of defense articles and defense services in anticipation of their future transfer under the Arms Export Control Act (AECA), the Foreign Assistance Act (FAA) of 1961, as amended, or as otherwise authorized by law to partners and international organizations. The USG may use the fund as a means to deliver selected articles and services to partners in less than normal procurement lead-time and may preserve U.S. force readiness by reducing the need to divert assets intended for use by these U.S. forces to meet partners’ urgent requirements.

SDAF.2.1. Account Funding and Capitalization. The Special Defense Acquisition Fund (SDAF) operates as a financially-independent revolving fund. When title of SDAF-purchased assets are transferred to a foreign government or international organization, the proceeds from the transaction are reimbursed to the SDAF and used to finance subsequent purchases. The account is capitalized using selected proceeds from Foreign Military Sales (FMS), as authorized in Section 51(b) of the Arms Export Control Act (AECA), 22 U.S.C. 2795(b). Congress approved the Administration’s request to recapitalize the fund with the enactment of the Department of State (State), Foreign Operations, and Related Programs Appropriation Act, 2012 (Division I, Public Law (PL) 112-74), which authorized the Department to conduct a one-time transfer of up to $100 million from the FMS Administrative Surcharge Account to the SDAF and obligate up to $100 million from the account through September 30, 2015.

SDAF.2.1.1. Fund Classification. In accordance with the Financial Management Regulation (DoD FMR), Volume 12, Chapter 1, Section 6.2 the SDAF is a DoD Public Enterprise Fund.

SDAF.2.1.2. Fund Symbol. The SDAF account symbol assigned by the Department of Treasury is 11-4116.

SDAF.2.1.3. Obligation Authority. The SDAF operates within the limits established by the Congress (see 22 U.S.C. 2795). None of the funds in the account may be obligated without prior Congressional approval of an obligation limitation determined in appropriation acts during the annual budgeting process. Since the SDAF was reconstituted in 2012, the obligation authority for the Fund has been annually provided in the State, Foreign Operations and Related Programs Appropriation Act.

SDAF.2.1.4. Capitalization Limit. The capitalization limit for the fund is provided in 10 U.S.C. 114(c). This amount is calculated as the sum of the original $100M cash balance in the account provided from Fiscal Year (FY) 2012 plus the total monetary value of the offsetting collections received. The capitalization limit may not exceed $3.5B per the FY23 National Defense Authorization Act (NDAA), P.L. 117-263.

SDAF.2.1.5. Account Capitalization. Section 51(b) of the AECA, as amended (22 U.S.C. 2795), authorizes the transfer of offsetting collections received under FMS Letters of Offer and Acceptance (LOAs) that are executed under the authority of section 21 of the AECA to the SDAF. In accordance with this authority, the Fund may be capitalized with monies authorized and appropriated or otherwise made available for the purposes of the SDAF for the following charges on export sales by the USG and its contractors:

- Nonrecurring Cost (NC) recoupment charges of non-recurring research, development, and production costs;

- Asset-use charges for the use of U.S. Government-owned facilities and equipment by U.S. industry or private interests in the performance of an FMS case (excludes charges for FMS leases authorized under Section 61 of the AECA (22 U.S.C. 2796)); section 9104 of the DoD Appropriations Act, 1990 (P.L. 101-165) (“Fair Pricing” Legislation), however removed the application of asset use charges to FMS cases; and

- Collections from the sale of defense articles not intended to be replaced under FMS LOAs that are executed under the authority of section 21 of the AECA (22 U.S.C. 2761). Funds collected from the transfer of equipment from DoD stock pursuant to Title 10 or Title 22 Building Partner Capacity (BPC), as well as non-repayable Foreign Military Financing (FMF), authorities are not legally authorized to be deposited into the SDAF. Proceeds from BPC and non-repayable FMF-funded transfers of equipment not intended, or unable to be replaced, should be deposited into Miscellaneous Receipts.

SDAF.2.1.5.1. Definition of Section 51(b) Criteria.

SDAF.2.1.5.1.1. Items not Requiring Replacement. Items not requiring replacement are articles on FMS cases that will be requisitioned and delivered to the foreign partner from DoD stock and are not intended to be replenished or replaced. This includes all Excess Defense Articles (EDA) sold directly by an Implementing Agency (IA), or via a Defense Logistics Agency (DLA) Disposition Services case, via FMS LOAs under the authority of Section 21 of the AECA. Funds collected from the transfer of equipment from DoD stock pursuant to Title 10 or Title 22 BPC (listed in Table AP8.T3. Security Assistance and Security Cooperation Programs) and FMF authorities are not legally authorized to be deposited into the SDAF. Proceeds from BPC and FMF-funded transfers of equipment not intended or unable to be replaced must be deposited into Miscellaneous Receipts. IAs will use the correct FMF Type of Assistance (TA) code ("N") found in Figure C5.F5. to ensure funds collected pursuant to FMF-funded sales are properly identified. See DSCA Policy Memo 23-14.

SDAF.2.1.5.1.2. Non-Recurring Cost Recoupment Charges. NC recoupment charges are valued based on research, development, and production costs, and should be included as a portion of the item's value on an FMS case to be paid by the foreign partner to the USG. Section 21 of the AECA (22 U.S.C. 2761) requires the recoupment of NC from FMS customers. DSCA may waive collections under the authorities provided in Section 21(e)(1)(B) (22 U.S.C. 2761(e)(1)(B)) and Section 21(e)(2) (22 U.S.C. 2761(e)(2)) in the AECA, but all non-waived costs are to be collected into the SDAF account.

SDAF.2.1.5.1.3. Asset Use Charges. Asset-use charges relate to revenue derived from U.S. industry or private interests as a result of their use of government property in the performance of an FMS case. These charges are wholly different from those derived from leases with foreign countries or international organizations under Section 61 of the AECA. An asset use charge a charge against each identifiable recipient for special benefits derived from Federal activities beyond those received by the general public. Asset use charges are almost exclusively associated with the use of USG-owned industrial plants and associated USG-owned real estate by commercial entities. Congress authorized capitalization of SDAF with asset use charges in 1985. Prior to November 30, 1989, DoD charged a one percent asset use charge for FMS cases. However, this type of administrative charge was canceled with the “Fair Pricing” Legislation in the DoD Appropriations Act, 1990 (PL 101-165, Section 9104). Since asset use charges are no longer assessed as part of the FMS price, in accordance with DoD FMR, DoD 700.14R, Volume 15, Chapter 7, Section 13.8), SDAF capitalization from an asset use charge should not occur.

SDAF.2.1.5.1.3.1. A lease depreciation cost is not synonymous with an asset use charge. Foreign Military Lease proceeds recouped under Section 61 of the AECA cannot be deposited into the SDAF. DoD FMR, 700.14R, Volume 15, Chapter 1, Section 010202.

SDAF.2.1.5.2. Examples of Collections that Satisfy Section 51(b) Criteria.

SDAF.2.1.5.2.1. Defense Articles Not Requiring Replacement Pursuant to Section 51(b)(1) of the Arms Export Control Act:

- EDA are items not requiring replacement. All proceeds from the sale of EDA items under Section 21 of the AECA (22 U.S.C. 2761), based on their sales price in the LOA, will be deposited into the SDAF. This includes all EDA sold directly by an IA under LOAs.

- Excess article proceeds include proceeds resulting from sales executed under Section 21 of the AECA by DLA Disposition Services in the performance of any reuse, recycling, and disposal services.

- Proceeds from the sale of stock not to be replaced under Section 21 of the AECA. As an example, the Mine Resistant Ambush Protected (MRAP) vehicle is currently in the U.S. Army's inventory and additional end items will not be procured. If the U.S. Army decides to sell an MRAP to a foreign partner from its current stock, the proceeds from the sale must be identified and coded appropriately on the FMS case and collected by the U.S. Army and transferred to the SDAF.

- When defense articles are sold via Section 21 of the AECA with an intent to be replaced, but the window to repurchase the articles is expired, or the need/capability no longer exists, funds on the lines shall be treated as proceeds from the sale of stock not to be replaced and transferred to the SDAF.

- Residual/excess funds from the sale of defense articles under the authority of Section 21 of the AECA and their subsequent replacement in-kind (i.e. replacement with an item of the identical type, model, and series or modified version of the same basic model) are to be collected in the SDAF account 97-11X 4116. Residual funds will be handled in the same manner as direct proceeds from "Items Not Requiring Replacement" because the remaining funds are not sufficient to replace an item in-kind.

- Residual/excess funds from the sale of defense articles and their subsequent replacement with dissimilar defense articles (i.e. a later series or modified version of the same basic model that was sold, or an acceptable substitute item), excluding the sale of ammunition or items valued at less than $5,000, must be reprogrammed into the IA’s procurement account and reflected in the Direct Budget Plan. Consequently, these funds are merged with other IA procurement funds and cannot be separately identified for deposit into SDAF.

- Residual/excess funds from the sale of ammunition items or defense articles valued at less than $5,000 and their subsequent replacement with dissimilar defense articles are to be treated in the same way as funds being used for a replacement in-kind as long as the replacement item is providing the same warfighting capability.

*Collections from the purchase of defense articles under Title 10 and Title 22 Building Partnership Capacity authorities or via FMF-funded Letters of Offer and Acceptance do not satisfy Section 51(b)(1) (22 U.S.C. 2795(b)(1)) criteria and therefore, cannot be transferred into SDAF as a matter of law.

SDAF.2.1.5.2.2. SDAF.2.1.5.2.2. Nonrecurring Cost Recoupment Charges under Section 51(b)(2) of the Arms Export Control Act. These include all applicable and charged NC recoupment charges on Major Defense Equipment (MDE) sold via an FMS case. Unless a full waiver for NC recoupment is granted to the foreign partner, the associated charges (or a percentage, depending on the waiver terms) for MDE sales must be collected and transferred to the Special Defense Acquisition Fund (SDAF). DSCA will monitor the amount recouped by each MDE item. For reconciliation of NC recoupment charges where a credit to the SDAF account needs to be returned, see Section SDAF.2.1.5.4.4. NC recoupment charges do not apply if the Term of Sale is FMF or Military Assistance Program (MAP) funds. See Section C9.4.5.

SDAF.2.1.5.2.3. Asset Use Charges under Section 51(b)(2) of the Arms Export Control Act. No asset use charges should be included on FMS, BPC, or FMF cases, as “Fair Pricing” Legislation removed its inclusion as a component of pricing on FMS cases. Commercial sales of defense articles to any foreign country or international organization includes charges for use of USG-owned facilities, plants, and production or research equipment in connection with the production of the defense articles. Collections of these costs are deposited into the Miscellaneous Receipts Account 3041 (see Section C9.4.4.1.). Further, charges derived from leases with foreign countries or international organizations under Section 61 of the AECA (22 U.S.C. 2796) do not constitute asset use charges and are not authorized to be transferred to the SDAF.

SDAF.2.1.5.3. Section 51(b) Criteria Coding. Table SDAF.T1. lists codes that the IAs must use to identify and properly code offsetting collections from an FMS case line. DSCA established these codes to 1) differentiate collection types to be deposited into the SDAF and 2) identify case lines that include proceeds that should be deposited into the SDAF. Per Section SDAF.2.1.5., funds from these FMS case lines are required to be transferred to the SDAF. These codes are in the Defense Security Assistance Management System (DSAMS) RP030 report and are classified as either Primary Category Codes (PCCs) or Indirect Pricing Components (IPCs). Periodically, the table will be reviewed and updated as necessary. MILDEPs and IAs are responsible for communicating updated coding information to DSCA (Office of Business Operations, Comptroller Directorate, Security Assistance Division (OBO/CMP/SA)).

SDAF.T1. Section 51(b) Criteria Coding

SECTION 51(B) CRITERIA | CODING | ARMY | NAVY | AIR FORCE |

|---|---|---|---|---|

Items Not Requiring Replacement | PCC | 741, 770, 740 | 350, 479 | 50, 74, 52 |

NC Recoupment Charges1 | IPC | A0610 | A0610 | A0610 |

Asset Use Charge2 | PCC | N/A | N/A | N/A |

Notes: 1 currently in use 2 canceled with the “Fair Pricing” Legislation in the DoD Appropriations Act | ||||

SDAF.2.1.5.4. Processing Offsetting Collections. Before processing offsetting collections, IAs must verify if charges have been billed to the customer for NC recoupment charges or if title has transferred for items not requiring replacement. Reporting the shipment of articles must remain in compliance with the DoD FMR 7000.14-R Volume 15, Chapter 8, Section 2.3.2.

SDAF.2.1.5.4.1. DSCA established the SDAF collection receipt account 97-11X 4116 for all three sources of offsetting collections listed in Section SDAF.2.1.5., and the IAs are to post SDAF collections into this account for capitalization purposes. To transfer funds to 97-11X 4116, an IA must prepare a Standard Form (SF) 1080, a voucher for transfers between appropriations and/or funds. Regardless of the Term of Sale, type of payment schedule or if there’s a Special Billing Arrangement in place, the appropriate IA case or financial manager will send the SF 1080 to DSCA within 30 calendar days of title transfer for the sale of stock not requiring replacement or from case implementation for NC recoupment charges. IAs should submit the vouchers and supporting documentation to the DSCA (OBO/CMP/SA) SDAF shared mailbox: dsca.ncr.bpc.mbx.sdaf-financials@mail.mil. DSCA (OBO/CMP/SA) will review the SF 1080 voucher for errors and record the Case Identifier (ID), MILDEP, Line of Accounting, PCC/IPC, Offsetting Collection Type and Date of Submission for tracking purposes. If the package contains no errors, DSCA (OBO/CMP/SA) will approve the package and forward it to the appropriate Defense Finance and Accounting Service (DFAS) office for processing.

SDAF.2.1.5.4.2. Foreign Military Sales Offsetting Collection Packages. IAs must provide complete and accurate offsetting collections packages to DSCA regardless of whether the funds are being transferred to the Treasury’s miscellaneous receipts account (3041) or to SDAF. SDAF offsetting collection packages will be reviewed and approved by DSCA CMP SA. Collections going to the Treasury will be reviewed to ensure the case line is coded properly, i.e., MILDEPs are transferring funds to 3041 that are unauthorized for SDAF (BPC, non-repayable FMF, etc.). The guidance below is intended to standardize each offsetting collections package developed by the IAs to enable more efficient processing. Complete packages include the following items.

- A complete and electronically certified SF 1080, to include the obligating document number and full line of accounting, which must include the limit and fiscal station number

- A copy of the obligating document at a case/line level, which must contain the obligating document number referenced on the SF 1080

- Confirmation that title transfer has occurred for articles sold without replacement on the case

- DSAMS RP005 current implemented case report containing only the applicable pages relevant to the transfer

- Additional documentation to validate the PCC/IPC (e.g., RP069 report, etc.)

- Applicable only for offsetting collection packages associated with non-recurring cost recoupment charges: DSAMS non-recurring cost recoupment charge “waived and applied” DSAMS report or other supporting documentation that can verify the amount being collected is an authorized non-recurring cost recoupment charge

SDAF.2.1.5.4.2.1. The below Standard Financial Information Structure (SFIS) attributes must be included in the "Office Receiving Funds" portion of the voucher. These attributes are shown in Table SDAF.T2.:

SDAF.T2. Standard Financial Information Structure Attributes and Names

STANDARD FINANCIAL INFORMATION STRUCTURE ATTRIBUTE | ATTRIBUTE NAME | SPECIAL DEFENSE ACQUISITION FUND ATTRIBUTE |

|---|---|---|

BA | Budget Activity | 20 |

BSA | Budget Sub-Activity | 000000 |

BLI | Budget Line Item | 00000000 |

SAHI | Sub-Allocation Holder Identifier | Varies based on the IA submitting the voucher |

BALI | Budget Allotment Line Item | Varies based on offsetting collection type |

SDAF.2.1.5.4.2.2. Standard Financial Information Structure Line of Accounting and Fiscal Station Number on Offsetting Collection Vouchers. Starting October 1, 2021 (FY 2022), IAs and MILDEPs identifying offsetting collections and preparing vouchers to transfer funds to the SDAF must use appropriate SFIS attributes in the line of accounting consistent with Table SDAF.T2. If an IA or MILDEP cannot use SFIS attributes in a SF 1080's line of accounting due to the use of non-compliant systems, then the IA or MILDEP can reference SFIS attributes in the "Article and Services" field of the SF 1080. DSCA will use these lines of accounting to review and reconcile the SDAF offsetting collection data monthly. FMS cases implemented prior to FY 2022 do not require an amendment.

SDAF.2.1.5.4.2.3. Special Defense Acquisition Fund Account Crosswalk. The limits (sub-allocations) previously used to identify offsetting collections eligible for collection to the SDAF account will be updated for FY 2022 and going forward. Previous offsetting collections limits (sub-allocations) from FY 2012-FY 2021, referenced in Table SDAF.T4., will remain active to account for all offsetting collections transferred to the SDAF account. Table SDAF.T3. identifies the new limits and the appropriate SFIS attributes to use when completing an SF 1080 voucher for offsetting collections. For questions related to Table SDAF.T3. or the SFIS attributes, please contact DSCA's SDAF shared mailbox: dsca.ncr.bpc.mbx.sdaf-financials@mail.mil.

SDAF.T3. Special Defense Acquisition Fund Account Crosswalk for New Standard Financial Information Structure Attributes:

Military Department | Offices: | Line of Accounting |

|---|---|---|

Army | Office Receiving Funds: | Offsetting Collection Type: Nonrecurring Cost Recoupment Charges |

Office Receiving Funds: | Offsetting Collection Type: Items Not Requiring Replacement | |

Office Receiving Funds: | Offsetting Collection Type: Asset Use Charges | |

Navy | Office Receiving Funds: | Offsetting Collection Type: Nonrecurring Cost Recoupment Charges |

Office Receiving Funds: | Offsetting Collection Type: Items Not Requiring Replacement | |

Office Receiving Funds: | Offsetting Collection Type: Asset Use Charges | |

Air Force | Office Receiving Funds: | Offsetting Collection Type: Nonrecurring Cost Recoupment Charges |

Office Receiving Funds: | Offsetting Collection Type: Items Not Requiring Replacement | |

Office Receiving Funds: | Offsetting Collection Type: Asset Use Charges | |

SDAF.2.1.5.4.2.4. In addition to a line of accounting with SFIS attributes, the SF 1080 must contain a Fiscal Station Number (FSN), also referred to as an Authorization Accounting Activity (AAA) in the Navy, and an Accounting and Disbursing Station Number (ADSN) in the Air Force. The FSN used for the SDAF is 843000. Although the new SFIS line of accounting does not contain an FSN, MILDEPs should still enter FSN 843000 in the "Office Receiving Funds" section of the SF 1080. FSN 843000 enables DFAS to know where to route offsetting collections.

SDAF.2.1.5.4.3. Reporting Offsetting Collections. Table SDAF.T4. provides a comparison of the previous receipt accounts and limits (sub-allocations) where offsetting collections were sent prior to when DSCA directed the use of new SFIS compliant lines of accounting in September 2021. Table SDAF.T4. is for reference and reporting purposes only for offsetting collections sent mistakenly to 3041 or 97-11X 4116 using old lines of accounting. Table SDAF.T3. provides guidance on the new lines of accounting to be included on offsetting collection SF 1080 vouchers. All SF 1080 vouchers completed prior to the implementation date of the new lines of accounting will remain as processed, certified, and complete with no corrections necessary or required. The IAs shall not take action to initiate or process a correction voucher for previously submitted vouchers. If an IA determines that a correction to a previously submitted voucher is needed, it should contact DSCA (OBO/CMP/SA) SDAF budget analyst for guidance.

SDAF.T4. Historical Special Defense Acquisition Fund Account Crosswalk

Military Department | Section 51(b) Criteria | Old Receipt Account for Special Defense Acquisition Fund | Account for Special Defense Acquisition Fund Using Old Sub-Allocation Codes (Limits) |

|---|---|---|---|

Navy | Asset Use Charges | 17X 3041.1201 | 97-11X4116.6809 |

Items Not Requiring Replacement | 17X 3041.1202 | 97-11X4116.6808 | |

NC Recoupment Charges | 17X 3041.1205 | 97-11X4116.6807 | |

Army | NC Recoupment Charges | 21X 3041.0001 | 97-11X4116.6807 |

NC Recoupment Charges | 21X 3041.0002 | 97-11X4116.6807 | |

Items Not Requiring Replacement | 21X 3041.0003 | 97-11X4116.6808 | |

Items Not Requiring Replacement | 21X 3041.0004 | 97-11X4116.6808 | |

Asset Use Charges | 21X 3041.0006 | 97-11X4116.6809 | |

NC Recoupment Charges | 21X 3041.0010 | 97-11X4116.6807 | |

Air Force | Items Not Requiring Replacement | 57X 3041.0010 | 97-11X4116.6808 |

NC Recoupment Charges | 57X 3041.0012 | 97-11X4116.6807 | |

Items Not Requiring Replacement | 57X 3041.0020 | 97-11X4116.6808 | |

NC Recoupment Charges | 57X 3041.0027 | 97-11X4116.6807 | |

NC Recoupment Charges | 57X 3041.0029 | 97-11X4116.6807 | |

Asset Use Charges | 57X 3041.0040 | 97-11X4116.6809 | |

Asset Use Charges | 57X 3041.0048 | 97-11X4116.6809 | |

Items Not Requiring Replacement | 57X 3041.0080 | 97-11X4116.6808 | |

DoD | NC Recoupment Charges | 97X 3041.0001 | 97-11X4116.6807 |

Items Not Requiring Replacement | 97X 3041.0003 | 97-11X4116.6808 | |

Items Not Requiring Replacement | 97X 3041.0004 | 97-11X4116.6808 | |

Asset Use Charges | 97X 3041.0006 | 97-11X4116.6809 | |

Asset Use Charges | 97X 3041.0009 | 97-11X4116.6809 | |

SDAF.2.1.5.4.3.1. The FMS case lines involving the sale of items not requiring replacement will be tracked as available for expenditure and collection via a monthly offsetting collection reconciliation report. The report will be created by DSCA (OBO/CMP/SA), pulled monthly from DSAMS, and provided to all MILDEPS for status updates. If title has transferred on sold assets, the FMS case line is then eligible for collection into the SDAF account. If a line is outstanding, the MILDEP shall provide an update on when the offsetting collection package will be submitted to DSCA (OBO/CMP/SA). MILDEPs shall prepare offsetting collection packages using guidance from Section SDAF.2.1.5.4.2.

SDAF.2.1.5.4.4. In the event there is an FMS case line where a credit to the SDAF needs to be returned to the FMS case as a correction to the offsetting collections, the MILDEP must first contact DSCA (OBO/CMP/SA) for guidance. Correction vouchers shall be routed through the DSCA (OBO/CMP/SA) SDAF shared mailbox dsca.ncr.bpc.mbx.sdaf-financials@mail.mil. DSCA requires IAs to keep a copy of the certified offsetting collection vouchers and to provide a copy of them if requested.

SDAF.2.1.5.4.5. Case managers shall maintain the SF 1080 and SF 1081 in case files for reconciliation between the IA financial system and the Defense Integrated Financial System (DIFS).

SDAF.2.1.6. Administrative Costs. SDAF administrative operating costs are included in the FMS administrative budget. However, the SDAF does have the authority to pay for additional administrative operating costs, if necessary.

SDAF.2.1.7. Cost Recovery. SDAF defense articles and defense services should be procured, transported, receipted, stored, maintained, physically inventoried, and disposed of (if needed) using SDAF only, and at no cost to other appropriated funds or other Security Assistance Account (SAA) funds, unless a case line is identified. The intent is to begin to utilize case funds as soon as practical. Any future obligations incurred for a specific partner requirement should be funded from their associated case. SDAF case lines will be priced to recover all proportionate costs to SDAF for the associated SDAF defense article or defense service.

SDAF.3.1. Department of State, Bureau of Political and Military Affairs. Department of State, Bureau of Political and Military Affairs (State (PM)) approves Special Defense Acquisition Fund (SDAF) purchases in coordination with DSCA.

SDAF.3.2. Defense Security Cooperation Agency. DSCA directs and oversees the implementation of the SDAF within the DoD, to include approving SDAF purchases in coordination with State.

SDAF.3.3. Implementing Agencies. The Implementing Agencies (IAs) develop and submit SDAF procurement proposals to DSCA. IAs direct and oversee the transfer of SDAF-procured defense articles and services to partners.

SDAF.3.4. Military Departments. The Military Departments (MILDEPs) develop and submit SDAF procurement proposals to the applicable IA within each MILDEP (see Section SDAF.4.3.). Receives, maintains, and stores defense articles procured through the SDAF until they are transferred to partners.

SDAF.3.5. Combatant Commands. The Combatant Commands (CCMDs) develop and submits SDAF procurement proposals to the applicable IA.

SDAF.4.1. Procurement of Defense Articles and Defense Services. DSCA, in consultation with the Department of State, Bureau of Political-Military Affairs (State (PM)), selects the defense articles and defense services to be purchased by the Special Defense Acquisition Fund (SDAF). The Military Departments (MILDEPs)/Implementing Agencies (IAs) execute the purchases, and in coordination with DSCA, maintain accountability of the purchased articles and services until they are sold and transferred to a partner or building partner capacity program in accordance with the laws, regulations, and rules that govern such transactions.

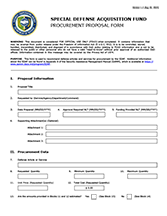

SDAF.4.2. Procurement Proposals. To request SDAF funds, DoD Components must download and complete the Figure SDAF.F1. - SDAF Procurement Proposal Form.

Figure SDAF.F1. - Special Defense Acquisition Fund Procurement Proposal Form

SDAF.4.2.1. Secondary and Stock Items. Secondary or stock items that are critical or essential to the operation of a major end item will be considered for procurement. Complete spare parts packages are usually not appropriate. Exceptions can be made on a case-by-case basis. Items managed by the Defense Logistics Agency (DLA) and the General Services Administration (GSA) are not normally considered for SDAF buys.

SDAF.4.2.2. Transportation Costs. All estimated costs that are expected to be incurred to transport SDAF articles to an assembly or holding point that are not included in the procurement unit price should be included as a separate cost on the SDAF Procurement Proposal Form (see Figure SDAF.F1.). These transportation costs need to be paid with current appropriated SDAF funds, at the date of shipment to an assembly or holding point. Approved SDAF proposals may require multiple issuances of SDAF funds to account for changes in cost due to the time lapse from when the proposal is approved and funded, to the actual date of shipment of the defense articles to the assembly or holding point. SDAF inventory is considered DoD assets, and as such, DoD rates (rather than non-DoD rates) should be applied. Any future obligations incurred for a specific partner requirement should be funded from their associated case, applying non-DoD rates.

SDAF.4.2.2.1. If costs are not known at the time and have since been identified as being required and spent to transport and store SDAF articles, the Financial Analysis Worksheet (FAW) shall be updated so that the costs are included as part of the total price at the line level on the Foreign Military Sales (FMS) Case. Afterwards, submit the updated FAW, along with the Asset Allocation Form, to DSCA (Office of International Operations, Global Execution Directorate, Case Writing and Development Division (IOPS/GEX/CWD)) for review (see Section SDAF.6.4.).

SDAF.4.2.3. Receipt, Storage, Maintenance, Physical Security, and Physical Inventory Costs. The costs that are expected to be incurred for the receipt, storage, maintenance, physical security, and physical inventory of the item must be included in the SDAF Procurement Proposal Form (see Figure SDAF.F1.). Approved SDAF proposals may require multiple issuances of SDAF funds to account for cost variances from when the proposal is approved and funded, to the actual date of receipt, storage, maintenance, physical security, and physical inventory requirements. SDAF inventory items are considered DoD assets, and as such, DoD rates rather than non-DoD rates should be applied.

SDAF.4.2.3.1. If the costs are not known at the time the form is submitted, then a separate request from the IA to DSCA (Office of Business Operations, Comptroller Directorate (OBO/CMP)) can be coordinated to facilitate the funding of storage and maintenance costs, once costs are known. All known receipt, storage, maintenance, physical security, and physical inventory costs are to be identified on the FAW, along with the Asset Allocation Form, to DSCA (IOPS/GEX/CWD) for review (see Section SDAF.6.4.).

SDAF.4.3. Procurement Proposal Submission. Proposals may be submitted to DSCA at any time during the year. DSCA will not accept a proposal, however, until it has been reviewed by:

- The Office of the Deputy Under Secretary of the Air Force, International Affairs,

- The Office of the Deputy Assistant Secretary of the Army for Defense Exports and Cooperation,

- The Office of the Deputy Assistant Secretary of the Navy for International Programs, or

- The Directorate of International Affairs, Missile Defense Agency.

SDAF.4.4. Proposal Review and Approval Process. A procurement proposal is added to the Unfunded Proposal List (UPL) when it is received by DSCA. DSCA, in consultation with the State (PM), reviews the UPL and selects the proposals to fund at scheduled times during the year. DSCA coordinates with the Office of the Deputy Assistant Secretary of Defense for Security Cooperation ODASD(SC), the Joint Chiefs of Staff, Directorate for Strategic Plans and Policy (JCS (J-5)), and others, as needed when considering approval or disapproval of a proposal. Proposals that are not approved during a review period remain on the UPL until the proposal is rescinded by the requesting organization or is deemed to be no longer executable.

SDAF.4.5. Urgent Procurement Proposal Submissions. Procurement proposals that require immediate attention must be reviewed in accordance with Section SDAF.4.3. and Section SDAF.4.4. but will be coordinated by DSCA outside of previously scheduled reviews.

SDAF.5.1. Special Defense Acquisition Fund (SDAF) use does not require notification to Congress prior to funds execution. However, DSCA, in coordination with the Department of State (State), is required to provide quarterly spend plans to the appropriate congressional committees, as well as an annual report that identifies the defense articles and services that were acquired, possessed, and transferred through SDAF during the previous fiscal year (FY).

SDAF.6.1. Funds Distribution and Execution. Special Defense Acquisition Fund (SDAF) funds are distributed by the DSCA (Office of Business Operations, Comptroller (OBO/CMP)) team to the Implementing Agencies (IAs) and Military Departments (MILDEPs) on a Funding Authorization Document (FAD) in the Electronic Funds Distribution (EFD) system once an obligation plan has been provided to the DSCA (OBO/CMP) SDAF Budget Analyst.

Table SDAF.T5. - Special Defense Acquisition Fund Distribution

Military Department: | Funds Issued To: |

|---|---|

U.S. Air Force | Secretary of Air Force Financial Management Budget Operations (SAF(FMBOO)) |

U.S. Army | Assistant Secretary of the Army (Acquisition, Logistics and Technology) (ASA (ALT)), Deputy Assistant Secretary of the Army for Defense Exports and Cooperation (DASA (DE&C)) |

U.S. Navy | Office of the Deputy Assistant Secretary of the Navy International Programs Office (NIPO) and Financial Management and Budget (FMB-33) |

Missile Defense Agency | Office of the Comptroller/Chief Financial Officer, Missile Defense Agency (MDA) |

SDAF.6.1.1. Military Interdepartmental Purchase Request. When necessary, SDAF funds may be issued on a Military Interdepartmental Purchase Request (MIPR), Defense Department (DD) Form 448. The MIPR may be accepted as direct cite or reimbursable. Acceptances (DD Form 448-2) must be provided to the DSCA (OBO/CMP) no later than ten (10) days after acceptance. DSCA will not issue a MIPR when the requested funds can be distributed in the EFD system.

SDAF.6.1.2. Compliance with Acquisition Regulations and Procedures. SDAF procurements must be made in accordance with DoD regulations and procedures, as outlined in the Federal Acquisition Regulation (FAR) and the Defense FAR Supplement (DFARS). SDAF procurements do not necessarily follow the international agreements exception to full and open contracting competition, as outlined in the Competition in Contracting Act (CICA) (10 U.S.C. 3204(a)), the FAR Subpart 6.302-4, and the DFARS Subpart 206.302-4.

SDAF.6.1.3. Excess Funds. If distributed funds are not needed, they must be returned to DSCA.

SDAF.6.2. Allocation of Defense Articles and Services Purchased by the Special Defense Acquisition Fund. SDAF-procured assets are allocated in accordance with the laws, regulations, and policies that apply to all foreign military sales and transfers.

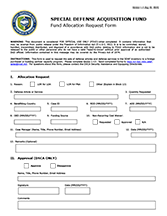

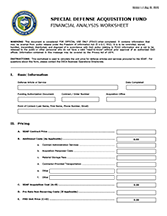

SDAF.6.2.1. Pricing Rules. The allocation process begins when an eligible partner, international organization, or building partner capacity program requests information on defense articles and/or services, and the articles and/or services are available in the SDAF inventory. When such a request is received, the MILDEP/IA should verify the availability of the requested asset and then submit an SDAF Asset Allocation Request (see Figure SDAF.F2.) and Financial Analysis Worksheet (FAW) (see Figure SDAF.F3.) to the DSCA SDAF Program Manager. If the request is approved, DSCA will sign and return the SDAF Asset Allocation Request and FAW to the MILDEP/IA. These documents must be included with the Foreign Military Sales (FMS) or Building Partner Capacity (BPC) case when it is sent to the DSCA (Office of International Operations, Global Execution Directorate, Case Writing and Development Division (IOPS/GEX/CWD)). Once a case is offered, the SDAF assets on the case will be held in reserve until the Offer Expiration Date (OED) expires.

SDAF.6.2.2. Types of Sales. Sales are typically made from assets in the SDAF inventory. In instances where a defense article has been purchased by the SDAF but not yet delivered to the USG or contractor storage facility, the customer may purchase the SDAF-owned equity via direct shipment from the acquisition contract.

SDAF.6.3. Special Defense Acquisition Fund Allocation Request. An approved allocation request authorizes the IA to offer the requested item or service to a partner, international organization, or BPC program. Allocation Messages are reviewed periodically by DSCA and the MILDEPs to ensure actions are complete or to initiate proper follow-up actions.

SDAF.6.4. Financial Analysis Worksheet. The FAW provides the SDAF unit sales price. A separate FAW must be completed for each SDAF line on a case. The FAW must reference the FAD or MIPR that was issued by DSCA (OBO/CMP) to procure the items and services.

SDAF.6.4.1. The FAW shall be updated so that all costs are included as part of the total price at the line level on the FMS Case when the FAW is submitted, along with the Asset Allocation Form, to DSCA (IOPS/GEX/CWD).

SDAF.6.5. Price and Availability Data. IAs must coordinate with DSCA before responding to a request for price and availability data (P&A) for items and services on contract for SDAF or in the SDAF inventory. To submit such a request, IAs must complete the form shown in Figure SDAF.F2. - SDAF Allocation Request and submit it to DSCA SDAF Program Manager. If DSCA approves the proposed allocation, the IA will provide the customer with pricing and availability data through standard FMS procedures. The P&A data will contain an expiration date (usually 90 days), which the IA may extend in coordination with DSCA.

Figure SDAF.F2. - Special Defense Acquisition Fund Allocation Request

Figure SDAF.F3. - Financial Analysis Worksheet

SDAF.6.6. Letter of Offer and Acceptance Development Data.

SDAF.6.6.1. Source of Supply Code. The SDAF source code is “F.”

SDAF.6.6.2. Separate Case Lines. SDAF assets may be offered on a separate Letter of Offer and Acceptance (LOA) or as one or more separate lines on an LOA that includes articles and services that will not be sourced from the SDAF inventory. Sub-lines will not mix SDAF and non-SDAF material and services.

SDAF.6.6.3. Type of Assistance Code. The Type of Assistance (TA) code used for SDAF assets is 3, 6 or 8 if being funded with the applicable Terms of Sale listed in Figure C5.F5. paragraph 2.f., based on Arms Export Control Act (AECA) Section 21(b and d). For SDAF lines funded with FMS Credit, FMS Credit Non-Repayable, and Military Assistance Program (MAP) Merger, use the applicable credit TA code, also listed in Figure C5.F5. paragraph 2.f.. For instances when both cash and credit funding is provided on a line, both applicable cash and credit codes must be used.

SDAF.6.6.4. Support Items. When an SDAF-procured item is a component of an end item not purchased by the SDAF, the component item will be identified with a source of supply code "F" on its own line, and not in the end item line.

SDAF.6.6.5. Delivery Codes. SDAF uses three delivery codes, as shown in Table SDAF.T6.

Table SDAF.T6. - Special Defense Acquisition Fund Delivery Codes

Code | Description |

|---|---|

SA | Sale of items originally purchased from DoD inventories. |

SD | Sale of items procured from contractors by the SDAF. This delivery source code computes packing, crating, and handling (PC&H) cost. |

SE | Sale of items procured from contractors and shipped directly from the contractor to the customer, providing there is no requirement for any special PC&H. This delivery source code does not calculate PC&H cost. |

SDAF.6.6.6. A case note(s) is required for SDAF items and services and must convey that the line provides articles or services from SDAF inventory. The MILDEPs and IAs have the discretion to include additional information in the note, if needed.

SDAF.6.6.7. Case Amendments and Modifications. The preferred method is to allocate SDAF assets during the development of a basic case. Modifications and Amendments will only be used in accordance with Section C6.7. Change in scope for the SDAF lines should be limited to reduction in scope if necessary.

SDAF.6.6.8. Pricing Rules. SDAF lines are priced in accordance with the pricing guidance contained in DoD Financial Management Regulation (DoD FMR), DoD 7000.14.-R, to include transportation from the SDAF inventory storage location to the partner. The SDAF sales unit price is calculated to ensure SDAF is fully reimbursed for all costs incurred against SDAF (e.g. transportation, receipt, storage, maintenance, and physical inventory costs) as reflected on the SDAF FAW.

SDAF.6.6.8.1. Special Defense Acquisition Fund Sales Unit Pricing. The SDAF sales unit price for SDAF defense articles and services sold through the FMS process will be computed by starting with the SDAF contract unit price, and then adding additional proportionate charges in order to arrive at the SDAF sales unit price. Additional proportionate charges to be added include transportation, receipt, storage, maintenance, and physical inventory costs, as applicable to the SDAF inventory.

SDAF.6.6.8.1.1. Application of Select Pricing Elements. The SDAF sales unit price is all inclusive of the SDAF contract unit price and other costs. The FMS administrative surcharge is in addition to (and not a component of) the unit price and therefore should not be included in the SDAF sales unit price.

SDAF.6.6.8.2. Added Costs. The SDAF sales unit price must include charges incurred against SDAF to include transportation, receipt, storage, maintenance, physical inventory costs, etc., as applicable to the SDAF inventory. Any future obligations incurred for a specific partner requirement should be funded from their associated case.

SDAF.6.6.8.3. Non-Recurring Costs. Applicable Nonrecurring Costs (NC) paid by SDAF are included in the base price to arrive at the SDAF selling price. If the item being sold is classified as Major Defense Equipment (MDE) and the USG has developed an NC for the item (paid for by other than SDAF funds), that NC may be waived under normal procedures. If the NC is not waived, a new Military Articles and Services List (MASL) must be created for the SDAF sale so that the item will be reported as coming from the SDAF inventory and the NC is included in the pricing.

SDAF.6.6.8.4. Contract Administration Services Surcharge.

SDAF.6.6.8.4.1. Defense Contract Management Agency. Defense Contract Management Agency (DCMA) does not charge a Contract Administrative Services (CAS) surcharge for U.S. purchases (i.e., procurements conducted by and for the benefit of U.S. forces). SDAF procurements are considered U.S. purchases and therefore, CAS should not be applied to case lines that include SDAF-procured defense articles or defense services.

SDAF.6.6.8.4.2. Military Departments/Implementing Agencies. MILDEPs/IAs performing CAS functions in support of SDAF (i.e., Government-Owned/Contractor-Operated (GOCO) facility, etc.) will charge directly to their appropriated funds and then accomplish a cost transfer from SDAF to cover the charges. The MILDEPs/IAs will show costs on the SDAF FAW. Such costs will be incorporated into the SDAF unit price.

SDAF.6.6.9. Payment Schedules. FMS partners using the Special Defense Acquisition Fund (SDAF) source of supply (lines identified with an "F") must remit the full payment for total SDAF costs in the initial deposit. Payment for articles/services must occur at initial deposit for timely reimbursement to the SDAF.

SDAF.6.7. Case/Line Obligating Documents. After a case is implemented, the IA must establish an obligation for the SDAF asset(s) in their official financial system at the case/line level. The IA can use a Miscellaneous Obligating Requirements Document, if available.

SDAF.6.8. Reimbursement to the Special Defense Acquisition Fund. The IAs are responsible for SDAF reimbursement for the sale of SDAF assets transferred to a purchaser. The SDAF sales price is the amount that must be reimbursed. The DSCA (Office of Business Operations, Comptroller Directorate, Security Assistance Division (OBO/CMP/SA)), in coordination with the IA, assures reimbursement of the appropriate amount.

SDAF.6.8.1. Title Transfer. For procurement items being transferred via FMS, title passes at the vendor's loading facility. If items are supplied as a stock item from a DoD depot, title passes at the depot's loading facility. If items will be transported at various times due to the need for multiple shipments under one FMS case, then the IA/MILDEP should submit partial reimbursements on a case line basis upon title transfer as individual or groups of items leave the vendor’s loading facility or DoD depot, as applicable. For BPC cases where SDAF-procured articles are being provided, title will be retained by the Security Cooperation Organization (SCO) until such time that the benefitting partner is ready to accept physical delivery of the items. The MILDEP or IA will provide DSCA with the SDAF reimbursement package, within 90 days of the transfer of defense articles or performance of defense services to the purchaser, for review and processing. For BPC cases, the IA must submit an SDAF reimbursement package to DSCA after delivery of the last item on a given case line. SDAF reimbursement packages must be submitted at a case line level within 90 days of case implementation if services are fully rendered prior to the implementation date.

SDAF.6.8.2. Expenditure Transfer. The Defense Finance and Accounting Services - Indianapolis (DFAS-IN) will facilitate a reimbursement through an expenditure transfer, a Standard Form (SF)-1080 voucher, from the customer trust fund account to the SDAF account. DFAS-IN will transfer the funds from the SDAF account back to the customer with assistance from the MILDEP and DSCA’s Comptroller Security Assistance team if procurement or delivery is cancelled.

SDAF.6.8.3. Complete Reimbursement. The LOA obligates the purchaser to pay the total cost, just as with other standard procurements via FMS and BPC, to the USG, even if the actual costs exceed the original estimates provided in the LOA or amendment. The SDAF sales price will be adjusted if needed to ensure full reimbursement. DSCA, in coordination with the IA or MILDEP, assures reimbursement of the appropriate amount to the SDAF.

SDAF.6.8.4. Reimbursement Packages. The MILDEP or IA will provide DSCA the SDAF reimbursement package, within 90 days after title transfer, for review and processing. The reimbursement package must contain: a complete, electronically signed and certified SF-1080 for DSCA’s review and approval, a copy of the original obligation, a current copy of the implemented FMS Case, and supporting documentation to confirm that title has transferred.

SDAF.6.8.5. The sale of an item from the SDAF for a MILDEP or IA to provide support to a security cooperation or security assistance effort will be priced to recover the cost(s) incurred by the SDAF. SDAF assets cannot be sold to a MILDEP to support a DoD acquisition requirement.

SDAF.6.8.6. Presidential Drawdown. The SDAF-procured stock can be used to support Presidential Drawdowns on a case-by-case basis. IAs should direct any request for guidance to DSCA (Office of International Operations, Global Execution Directorate, Assistance & Monitoring Division (IOPS/GEX/AMD)).

SDAF.6.8.7. Reimbursing Funds Invested in Modifications of Assets Not Owned by the Special Defense Acquisition Fund. The SDAF can be used to finance equipment modification programs. The use of the SDAF for such purposes must be approved by DSCA. SDAF funds invested for such purposes must be listed as a separate line(s) on the case.

SDAF.6.8.7.1. Charge Required. A charge to recoup the SDAF investment must be included on a separate case line(s). The charge must be coordinated with DSCA in advance.

SDAF.6.8.7.2. Amortization. The amount of recoupment per unit is established by the DSCA (OBO), in consultation with the MILDEPs and the Office of the Under Secretary of Defense (Comptroller) (OUSD (C)).

SDAF.6.8.7.3. Process and Reporting Compliance. The same policies and procedures concerning the allocation and delivery reporting of SDAF assets, as well as the financial reimbursement to the SDAF, apply to the sale and transfer of modified assets.

SDAF.7.1. Reporting Obligations. Implementing Agencies (IAs) and Military Departments (MILDEPs) are required to provide DSCA (Office of Business Operations, Comptroller Directorate) (OBO/CMP)) a report by the 15th of each month on the obligation status and execution of allotted funding. This monthly execution data shall be supported with documentation from the IA’s financial system of record (General Accounting & Finance System (GAFS), General Fund Enterprise Business Systems (GFEBS), Navy Enterprise Resource Planning (NERP), etc.). Once an obligation formally takes place in the IA’s financial system of record, the IA must also provide a copy of obligating documents (e.g. procurement contracts, financial system funding document, etc.) for all costs, to include procurements, transportation, receipt, storage, maintenance, and physical inventory to the DSCA.

SDAF.7.1.1. Unobligated Funding. Upon analysis of reported obligation data, any funds identified as not being obligated to procure defense articles and defense services for Special Defense Acquisition Fund (SDAF) requirements during the period of availability, specified when obligation authority is granted, must be returned to DSCA by 30 September of the fiscal year in which obligation authority expires.

SDAF.7.1.2. Special Defense Acquisition Fund Procurement from Military Departments. In accordance with 10 U.S.C. 2205, SDAF funds provided to the IAs to acquire defense articles in DoD stock are available for obligation for the same period as the funds in the account to which they are transferred. Upon analysis of the reported obligation data, the provided funds that are not obligated by September 30 of the fiscal year in which funds expire should be returned to SDAF. After funds expiration, if some or all the previously-obligated funds are not executed prior to September 30 of the fiscal year in which funds are cancelled, any funds not disbursed should be returned to SDAF prior to funds cancellation.

SDAF.7.1.3. Inventory Control and Reporting of Special Defense Acquisition Fund Assets.

SDAF.7.1.3.1. Inventory Inspections and Reporting. Defense articles purchased by the SDAF and taken into property accountability by the MILDEPs require annual inspections and reporting to DSCA. MILDEPs are responsible for property accountability of all items financed by the SDAF for which custody is required. Inventory inspections will be conducted in accordance with DoD policies and procedures.

SDAF.7.1.3.2. Custodial Responsibility. The IAs, in coordination with DSCA, are responsible for storing and maintaining accountability of defense articles purchased by the SDAF until the items are transferred to the partner, international organization, or building partner capacity program. In addition, the IAs must establish controls to ensure SDAF assets are not transferred to a purchaser or used by the MILDEP unless coordinated with and approved by DSCA. IAs must ensure that DoD and contractor facilities are physically inventoried annually to determine the location, identification numbers ((e.g. National Stock Number (NSN), Part Number (PN), Managed Control Number (MCN)), and quantities of the SDAF-procured materiel on hand. All physical inventories must be completed before the end of the fiscal year and documented and reported to DSCA no later than 30 days after the end of the fiscal year.

SDAF.7.1.3.3. Inventory Storage and Payment. SDAF-procured items should be segregated from other items in the inventory until title transfers. The SDAF-procured items do not have to be physically segregated from other inventory, but the inventory manager must be able to maintain accurate accountability of the SDAF-procured items. All associated costs to include receipt, storage, maintenance, physical inventory, and disposal (if needed) must be paid or reimbursed with SDAF. See Section SDAF.4.2.3.

SDAF.7.1.3.4. Inventory Reports. Inventory reports must be submitted to DSCA no more than thirty (30) days after the end of a fiscal quarter. There is no required format that must be used when submitting the report, but at a minimum, the report must contain the information listed in Table SDAF.T7. Inventory reports shall be submitted to the DSCA SDAF Program Manager (PM). Annual inventory inspections must be reported to DSCA.

Table SDAF.T7. - Special Defense Acquisition Fund Inventory and Inspection Report

# | Requirement |

|---|---|

1 | Item description |

2 | NSN or PN, if applicable |

3 | Contract award date(s) |

4 | Quantity in stock |

5 | Quantity on order, to include estimated delivery dates |

6 | Quantity sold by partner and Letter of Offer and Acceptance (LOA) (case line) |

7 | Physical location of asset |

8 | Unit acquisition cost |

SDAF.7.1.3.5. Reporting Inventory Losses. If SDAF-procured items are lost while held in inventory, the responsible MILDEP or IA will conduct an investigation in accordance with the DoD Financial Management Regulation (DoD FMR), Volume 12. Results of the investigation will be forwarded to the Director, DSCA for disposition, to include the possible billing of the MILDEP or IA for the loss.

SDAF.7.1.4. Reporting and Disposal of Unserviceable Special Defense Acquisition Fund Assets. If SDAF inventory reaches the end of its serviceable life, the MILDEP/IA must report this information DSCA and coordinate to obtain written approval to dispose of any item purchased by SDAF. Disposal of SDAF inventory may only occur after obtaining written approval from DSCA. All costs associated with the disposal of the SDAF inventory must be paid using SDAF.

SDAF.7.1.5. Reimbursement Reporting. The IAs must provide monthly input to DSCA’s Comptroller Security Assistant reimbursement report. The IAs are required to provide a status update to DSCA on all implemented FMS case lines where a case line is eligible to reimburse the SDAF account, but the SDAF package has not been submitted to DSCA. The IAs are required to identify when DSCA can expect to receive the complete SDAF reimbursement package for review. Responses to the report are due by the third Wednesday of the month.

SDAF.8.1. The Special Defense Acquisition Fund (SDAF) is authorized in Section 51 of the Arms Export Control Act (AECA), 22 U.S.C. 2795, and in 10 U.S.C. 114(c).

Legislation | Subject |

|---|---|

Section 2795 provides that the Secretary of Defense (SECDEF), in consultation with the Secretary of State (SECSTATE), will establish the SDAF as a revolving fund separate from other accounts to procure defense articles and services in anticipation of their transfer through the AECA, the Foreign Assistance Act (FAA) of 1961, as amended, or as otherwise authorized by law to foreign countries and international organizations. The statute also identifies the sources of funds that the Administration can use to capitalize the account. | |

The size of the fund is provided in 10 U.S.C. 114(c). | |

Annual Department of State Foreign Operations and Consolidated Appropriation Act | Provides obligation authority for the SDAF account. |

SDAF.9.1. N/A